In 2019, Andes Corporation purchases $1.5 mil-lion of machinery (7-year property) and places it into service in

Question:

In 2019, Andes Corporation purchases $1.5 mil-lion of machinery (7-year property) and places it into service in its business. What are Andes' depreciation deductions for 2019 and 2020 in each of the following situations? Assume the half-year convention applies and this is the only property Andes places into service in 2019.

a. Andes does not elect Sec. 179 expensing and elects out of bonus depreciation.

b. Andes elects Sec. 179 expensing for the assets and does not elect out of bonus depreciation.

c. Andes does not elect Sec. 179 expensing and does not elect out of bonus depreciation.

Transcribed Image Text:

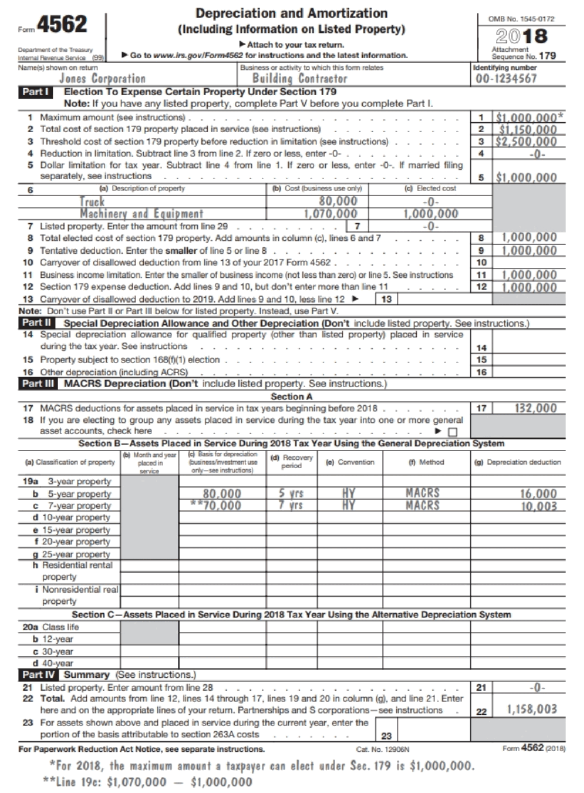

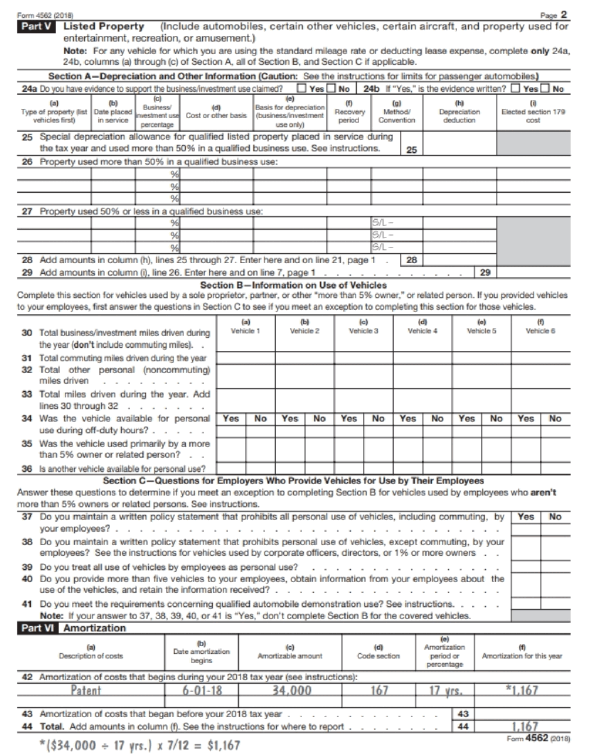

F4562 Department of the Treasury Internal Service (99) Name(s) shown on return Jones Corporation 6 Part I Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I. 1 Maximum amount (see instructions).. 2 Total cost of section 179 property placed in service (see instructions) 3 Threshold cost of section 179 property before reduction in limitation (see instructions) 4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0-. 5 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing separately, see instructions (a) Description of property Go to www.irs.gov/Form4562 Depreciation and Amortization (Including Information on Listed Property) Attach to your tax return. for instructions and the latest information. Business or activity to which this form relates Building Contractor 15 Property subject to section 168(1)(1) election. 16 Other depreciation (including ACRS) Part III MACRS Depreciation (Don't include listed property. See instructions.) Section A (a) Classification of property 19a 3-year property b 5-year property c 7-year property 17 MACRS deductions for assets placed in service in tax years beginning before 2018 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here d 10-year property e 15-year property f 20-year property g 25-year property h Residential rental property i Nonresidential real property Truck Machinery and Equipment 7 Listed property. Enter the amount from line 29 7 8 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 9 Tentative deduction. Enter the smaller of line 5 or line 8. 10 Carryover of disallowed deduction from line 13 of your 2017 Form 4562. 11 Business income limitation. Enter the smaller of business income (not less than zero) or line 5. See instructions 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 13 Carryover of disallowed deduction to 2019. Add lines 9 and 10, less line 12 ► 13 Note: Don't use Part II or Part III below for listed property. Instead, use Part V. Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year. See instructions (b) Cost (business use only) 80,000 1,070,000 Month and year placed in 80.000 70.000 20a Class life b 12-year c 30-year d 40-year Part IV Summary (See instructions.) (c) Elected cost -0- 1,000,000 -0- 5 yrs yrs HY Section B-Assets Placed in Service During 2018 Tax Year Using the General Depreciation System Basis for depreciation business/vestment use only-see instructions) Recovery period (e) Convention Method MACRS MACRS Identifying number 00-1234567 21 Listed property. Enter amount from line 28 22 Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter here and on the appropriate lines of your return. Partnerships and S corporations-see instructions 23 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 263A costs 1 $1.000.000* 2 $1.150.000 $2.500.000 -0- 5 $1,000,000 3 4 8 14 15 16 OMB No. 1545-0172 2018 Attachment Sequence No. 179 9 10 11 1,000,000 12 1.000.000 17 Section C-Assets Placed in Service During 2018 Tax Year Using the Alternative Depreciation System 23 For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 12906N *For 2018, the maximum amount a taxpayer can elect under Sec. 179 is $1,000,000. **Line 19c: $1,070,000 - $1,000,000 1,000,000 1,000,000 21 (a) Depreciation deduction 22 132,000 16,000 10.003 -0- 1,158,003 Form 4562 (2018) Form 4562 (2018) Page 2 Part V Listed Property (Include automobiles, certain other vehicles, certain aircraft, and property used for entertainment, recreation, or amusement.) Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable. Section A-Depreciation and Other Information (Caution: See the instructions for limits for passenger automobiles) 24a Do you have evidence to support the business/investment use claimed? Yes No 24b If "Yes," is the evidence written? Yes No (a) Type of property list Date placed vehicles first) in service Business (d) vestment use Cost or other basis percentage % % 25 Special depreciation allowance for qualified listed property placed in service during the tax year and used more than 50% in a qualified business use. See instructions. 26 Property used more than 50% in a qualified business use: 27 Property used 50% or less in a qualified business use: % 30 Total business/investment miles driven during the year (don't include commuting miles). 31 Total commuting miles driven during the year 32 Total other personal (noncommuting) miles driven 33 Total miles driven during the year. Add lines 30 through 32 34 Was the vehicle available for personal use during off-duty hours?.. Basis for depreciation (business/investment use only) 35 Was the vehicle used primarily by a more than 5% owner or related person? Yes % 96 28 Add amounts in column (h), lines 25 through 27. Enter here and on line 21, page 1 29 Add amounts in column (i), line 26. Enter here and on line 7, page 1 Complete this section for vehicles used by a sole proprietor, partner, or other more than 5% owner," or related person. If you provided vehicles to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles. Section B-Information on Use of Vehicles Vehicle 4 Vehicle 1 (1) Recovery period (b) Vehicle 2 Date amortization begins (a) Method/ Convention S/L- SAL- BIL- Vehicle 3 (c) Amortizable amount No Yes No Yes No Yes No 25 Description of costs 42 Amortization of costs that begins during your 2018 tax year (see instructions): Patent 6-01-18 34.000 43 Amortization of costs that began before your 2018 tax year 44 Total. Add amounts in column (f). See the instructions for where to report. *($34,000+ 17 yrs.) x 7/12 = $1,167 Depreciation deduction 28 (d) Code section 36 is another vehicle available for personal use? Section C-Questions for Employers Who Provide Vehicles for Use by Their Employees Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who aren't more than 5% owners or related persons. See instructions. 41 Do you meet the requirements concerning qualified automobile demonstration use? See instructions. Note: If your answer to 37, 38, 39, 40, or 41 is "Yes," don't complete Section B for the covered vehicles. Part VI Amortization 37 Do you maintain a written policy statement that prohibits all personal use of vehicles, including commuting, by Yes No your employees?. 38 Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your employees? See the instructions for vehicles used by corporate officers, directors, or 1% or more owners. 39 Do you treat all use of vehicles by employees as personal use? 40 Do you provide more than five vehicles to your employees, obtain information from your employees about the use of the vehicles, and retain the information received?.. 167 Vehicle 5 29 Yes No Yes No (0 Elected section 179 (0) Amortization period or percentage 17 yrs. (1) Vehicle 6 43 44 (1) Amortization for this year *1.167 1.167 Form 4562 (2018)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (10 reviews)

Solution a Andes depreciation deductions for 2019 and 2020 15 ...View the full answer

Answered By

James Warinda

Hi! I’m James Otieno and I'm an experienced professional online tutor with countless hours of success in tutoring many subjects in different disciplines. Specifically, I have handled general management and general business as a tutor in Chegg, Help in Homework and Trans tutor accounts.

I believe that my experience has made me the perfect tutor for students of all ages, so I'm confident I can help you too with finding the solution to your problems. In addition, my approach is compatible with most educational methods and philosophies which means it will be easy for you to find a way in which we can work on things together. In addition, my long experience in the educational field has allowed me to develop a unique approach that is both productive and enjoyable.

I have tutored in course hero for quite some time and was among the top tutors awarded having high helpful rates and reviews. In addition, I have also been lucky enough to be nominated a finalist for the 2nd annual course hero award and the best tutor of the month in may 2022.

I will make sure that any student of yours will have an amazing time at learning with me, because I really care about helping people achieve their goals so if you don't have any worries or concerns whatsoever you should place your trust on me and let me help you get every single thing that you're looking for and more.

In my experience, I have observed that students tend to reach their potential in academics very easily when they are tutored by someone who is extremely dedicated to their academic career not just as a businessman but as a human being in general.

I have successfully tutored many students from different grades and from all sorts of backgrounds, so I'm confident I can help anyone find the solution to their problems and achieve

0.00

0 Reviews

10+ Question Solved

Related Book For

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted:

Students also viewed these Business questions

-

However, CEO of Mill Export Co. is worried about the impact on stock price due to an increase in debt ratio. As a financial analyst, you are asked to conduct a thorough analysis to recommend an...

-

A person takes $4,000 and places it into a checking account in a bank. Does the composition of the money supply change? Does the size of the money supply change? Explain your answers.

-

Each of the following situations has an internal control weakness. a. Upside Down Applications develops custom programs to customers specifications. Recently, development of a new program stopped...

-

Using real employed samples, multiple field studies indicate that fat women experience more negative outcomes than fat men. In one study conducted by Steven Gortmaker and colleagues and using over...

-

Explain the difference between void and voidable. What is the practical result of this difference?

-

Malcolm owns 60% and Buddy owns 40% of Magpie Corporation. On July 1, 2016, each lends the corporation $30,000 at an annual interest rate of 10%. Malcolm and Buddy are not related. Both shareholders...

-

Find the temperature at which the surface tension of water becomes zero. What is the physical significance of this temperature?

-

Based on the information given, indicate whether the following industry is best characterized by the model of perfect competition, monopoly, monopolistic competition, or oligopoly. a. Industry A has...

-

What is the present Value of $5, 000 to be received in each of the following situations: a. at end of 10 years with a 5% discount rate. b. at the end of 7 years when the appropriate interest rate is...

-

Clapton Company manufactures custom guitars in a wide variety of styles. The following incomplete ledger accounts refer to transactions that are summarized for May: In addition, the following...

-

Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $1.7 million of depreciable property during 2019: You are working in Woburn's tax department and...

-

Anne Banks is a single, 60-year old retired teacher who does not itemize. Her only income is reported to her on the Fonn 1099-R provided by her retirement plan and the Form 1099-DIV provided by her...

-

True Or False A third-party claim occurs when there are at least three plaintiffs.

-

Which statement is the most accurate? a) Our poverty rate is somewhat higher today than it was in 1999. b) Our poverty rate is over 17 percent. c) If it were not for the 200709 recession, our poverty...

-

The poverty line is set by the _________.

-

The basic problem with the absolute concept of poverty is finding the _____.

-

Which statement is true? a) Most of the nations poor receive welfare benefits. b) Since the Welfare Reform Act of 1996, no new welfare cases have been accepted. c) More people than ever are receiving...

-

About ____________ percent of all poor people are black.

-

Determine I1 and I2 in the circuit of Fig. 13.106. 140 V

-

Determine the volume of the parallelepiped of Fig. 3.25 when (a) P = 4i 3j + 2k, Q = 2i 5j + k, and S = 7i + j k, (b) P = 5i j + 6k, Q = 2i + 3j + k, and S = 3i 2j + 4k. P

-

Lynn Swartz's husband died three years ago. Her parents have an income of over $200,000 a year and want to ensure that funds will be available for the education of Lynn's 8-year-old son Eric. Lynn is...

-

Albert established a qualified tuition program for each of his twins, Kim and Jim. He started each fund with $20,000 when the children were 5 years old. Albert made no further contributions to his...

-

Carey is a waiter at a restaurant that pays a small hourly amount plus tips. Customers are not required to tip the waiter. Carey is especially attentive and friendly, and her tips average 25% of the...

-

Consider a load balancing game with six jobs and two machines: both machines have speed 1 and the weights of the six jobs are 1, 2, 3, 3, 4 and 5, respectively. (a) [5 marks] Find a best pure Nash...

-

The table below contains prices, coupons and the time to maturity for three bonds. The bonds pay coupons annually and have a face value of $100. A 4-year zero coupon bond is also on issue in the...

-

Gather historical month-end price from Jan. 2010 to Jan. 2023 SP500 index (Ticker: GSPC) finance.yahoo.com and save them in an Excel file. Keep adjusted closing price. Calculate SP500, the market...

Study smarter with the SolutionInn App