In each of the following independent situations, determine the dividends received deduction for the calendar year C

Question:

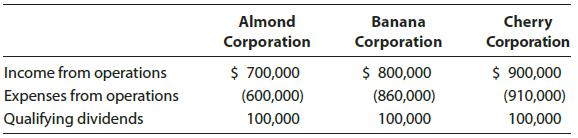

In each of the following independent situations, determine the dividends received deduction for the calendar year C corporation. The corporate shareholders own less than 20% of the stock in the corporations paying the dividends.

Transcribed Image Text:

Cherry Corporation Almond Banana Corporation Corporation $ 700,000 $ 800,000 $ 900,000 Income from operations Expenses from operations (600,000) (860,000) (910,000) Qualifying dividends 100,000 100,000 100,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 25% (4 reviews)

Following the procedure used in Example 38 in the text proceed as follows Consequently th...View the full answer

Answered By

Lamya S

Highly creative, resourceful and dedicated High School Teacher with a good fluency in English (IELTS- 7.5 band scorer) and an excellent record of successful classroom presentations.

I have more than 2 years experience in tutoring students especially by using my note making strategies.

Especially adept at teaching methods of business functions and management through a positive, and flexible teaching style with the willingness to work beyond the call of duty.

Committed to ongoing professional development and spreading the knowledge within myself to the blooming ones to make them fly with a colorful wing of future.

I do always believe that more than being a teacher who teaches students subjects,...i rather want to be a teacher who wants to teach students how to love learning..

Subjects i handle :

Business studies

Management studies

Operations Management

Organisational Behaviour

Change Management

Research Methodology

Strategy Management

Economics

Human Resource Management

Performance Management

Training

International Business

Business Ethics

Business Communication

Things you can expect from me :

- A clear cut answer

- A detailed conceptual way of explanation

- Simplified answer form of complex topics

- Diagrams and examples filled answers

4.90+

46+ Reviews

54+ Question Solved

Related Book For

South-Western Federal Taxation 2020 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357109175

23rd Edition

Authors: Annette Nellen, James C. Young, William A. Raabe, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

Now consider a four-year bond with a face value of $5,000 and an annual coupon payment of $125. Suppose prevailing interest rates in the economy are 4.0%. a. Calculate the predicted price of this...

-

Each of the following independent situations represents amounts shown on the four basic financial statements. 1. Revenues = $25,000; Expenses = $17,000; Net income = __________. 2. Increase in...

-

Each of the following independent situations has one or more control activity weaknesses. 1. Board Riders Ltd. is a small snowboarding club that offers specialized coaching for snowboarders who want...

-

For each polynomial function, find (a) (-1), (b) (2), and (c) (0). f(x)=x5x4

-

Draw the Hasse diagram for the "less than or equal to" relation on {0, 2, 5, 10, 11, 15}.

-

Choose the larger atom from each pair, if possible. a. Sn or Si b. Br or Ga c. Sn or Bi d. Se or Sn

-

Jack DeCoster owned Quality Egg, LLC, an Iowa egg production company. Jacks son, Peter DeCoster, served as the companys chief operating officer. Jack also owned and operated several egg production...

-

(EPS: Simple Capital Structure) On January 1, 2010, Chang Corp. had 480,000 shares of common stock outstanding. During 2010, it had the following transactions that affected the common stock account....

-

A house with a total living area of 2,500 square feet would cost $110 per square foot to reproduce new. It has an expected economic life of 50 years and is estimated to have an effective age of five...

-

At t = 0 a sealed test tube containing a chemical is immersed in a liquid bath. The initial temperature of the chemical in the test tube is 80 F. The liquid bath has a controlled temperature...

-

Cardinal Corporation, a calendar year taxpayer, receives dividend income of $250,000 from a corporation in which it holds a 10% interest. Cardinal also receives interest income of $35,000 from...

-

Janet, age 29, is unmarried and is an active participant in a qualified retirement plan. Her modified AGI is $66,000 in 2019. a. Calculate the amount Janet can contribute to a traditional IRA and the...

-

Repeat Prob. 1470 for a heat removal rate of 800 kJ/min.

-

1.True or False:The contribution to output growth of technological progress is estimated by how much of the output growth can be explained by the growth in inputs. 2. The chain index for GDP and the...

-

What are examples of companies that jump out to you that are doing Ries and Trout's laws particularly well. Who do you think is missing the mark with these laws?

-

When you claim that there are only two possible choices to address a problem, it is an example of?

-

The following production rate information was gathered from cost estimating data for a 4,000-foot pipeline installation project in rural Arizona. Complete the following: a. Utilizing this production...

-

Describe two or more instances of miscommunication in the A Failure to Communicate video. https://www.youtube.com/watch?v=8Ox5LhIJSBE

-

The following data are taken from the financial statements of Colby Company. ________ _ __ _________________________ __2019 2018 Accounts receivable (net), end of year........$ 550,000............$...

-

Phosgene, COCl2, is a toxic gas used in the manufacture of urethane plastics. The gas dissociates at high temperature. At 400oC, the equilibrium constant Kc is 8.05 104. Find the percentage of...

-

Create, Inc., produces inventory in its foreign manufacturing plants for sale in the United States. Its foreign manufacturing assets have a tax book value of $5 million and a fair market value of $15...

-

Create, Inc., produces inventory in its foreign manufacturing plants for sale in the United States. Its foreign manufacturing assets have a tax book value of $5 million and a fair market value of $15...

-

The trend in state income taxation is to move from an equal three-factor apportionment formula to a formula that places extra weight on the sales factor. Several states now use sales-factor-only...

-

Develop an algorithm, in the form of a Raptor flowchart, to compute and display the amount of federal income tax to be paid when provided with the income as input. The Canadian Federal income tax...

-

The graph below shows the number of people who consume different numbers of lollipops per year. What is the median number of lollipops consumed? Number of People 3 27 24 21 18 15 12 96 Number of...

-

a) Simplify the expression. Express your answer with positive exponents. (4x6) (4) (2x)* (123) 2 b) In 2004, a sum of $1900 is invested at a rate of 3.75% per year (compound interest) for 12 years....

Study smarter with the SolutionInn App