Julie Hernandez is single and has no dependents. She operates a dairy farm and her Social Security

Question:

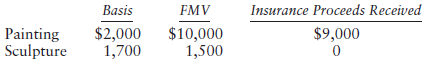

Julie Hernandez is single and has no dependents. She operates a dairy farm and her Social Security number is 000-00-1111. She lives at 1325 Vermont Street in Costa, Florida. Consider the following information for the current year:? Schedule C was prepared by her accountant and the net profit from the dairy operations is $48,000.? Itemized deductions amount to $4,185.? Dividend income (qualified dividend) amounts to $280.? State income tax refund received during the year is $125. She did not itemize last year.? In June, a burglar broke into her house and stole the following two assets, which were acquired in 1988:

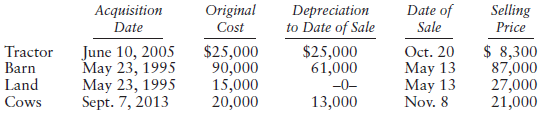

The following assets used in her business were sold during the year:

In August, three acres of the farm were taken by the state under the right of eminent domain for the purpose of building a highway. The basis of the three acres is $1,500, and the state paid the FMV, $22,000, on February 10. The farm was purchased on August 12, 1986.

Nonrecaptured net Section 1231 losses from the five most recent tax years preceding the current year amount to $7,000. Estimated taxes paid during the year amount to $32,000.Prepare Forms 1040, 4684 Section A, 4797, and Schedule D.?

Step by Step Answer:

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson