Latesha, a single taxpayer, had the following income and deductions for the tax year 2018: a. Compute

Question:

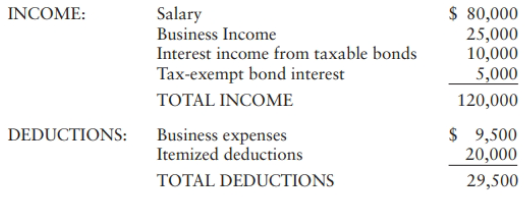

Latesha, a single taxpayer, had the following income and deductions for the tax year 2018:

a. Compute Latesha's taxable income and federal tax liability for 2018 (round to dollars).

b. Compute Latesha's marginal, average, and effective tax rates.

c. For tax planning purposes, which of the three rates in Part b is the most important?

Transcribed Image Text:

INCOME: $ 80,000 Salary Business Income Interest income from taxable bonds Tax-exempt bond interest 25,000 10,000 5,000 120,000 TOTAL INCOME DEDUCTIONS: $ 9,500 Business expenses Itemized deductions 20,000 TOTAL DEDUCTIONS 29,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (10 reviews)

a Income Salary Business income Interest income Deductio...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2019 Comprehensive

ISBN: 9780134833194

32nd Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Brad and Angie had the following income and deductions during 2016: Salaries $110,000 Interest income $10,000 Itemized deductions $16,000 Taxes withheld during the year $15,000 Calculate Brad and...

-

Cindy had the following income and deductions listed on her 2020 individual income tax return. Business income $37,000 Interest income on personal investments $5,000 Less Business expenses $40,000...

-

You client, Rob, has the following income and deductions for the financial year ended 30 June 2018: salary, $32,000; bank interest received, $150; and allowable deductions for special work clothing,...

-

Given a circularly linked list L containing an even number of nodes, describe how to split L into two circularly linked lists of half the size.

-

Consider a portfolio position of $10 million on which returns are assumed to be normally distributed with a current standard deviation of 20 percent per annum. The average VAR on the previous 60 days...

-

Why might vacuum columns be designed with a larger diameter above the feed compared to below the feed?

-

Many researchers are interested in the transcription of protein-encoding genes in eukaryotes. Such researchers want to study mRNA. One method that is used to isolate mRNA is column chromatography....

-

Bob Vance is unable to reconcile the bank balance at January 31. Bobs reconciliation is as follows. Cash balance per bank $3,560.20 Add: NSF check 690.00 Less: Bank service charge 25.00 Adjusted...

-

When considering the system resource model, Owens College would be viewed as effective; it receives a steady flow of highly academically qualified students and obtains significant endowment growth...

-

LargeCo is planning a new promotion in Alabama (AL) and wants to know about the largest purchases made by customers in that state. Write a query to display the customer code, customer first name,...

-

Based on the amounts of taxable income below, compute the federal income tax payable in 2018 on each amount assuming the taxpayers are married filing a joint return. Also, for each amount of taxable...

-

The PDQ Partnership earned ordinary income of $150,000 in 2018. The partnership has three equal partners, Pete, Donald, and Quint. Quint, w ho is single, uses the standard deduction, and has other...

-

In what industries would you expect to see particularly short technology cycles? In what industries would you expect to see particularly long technology cycles? What factors might influence the...

-

Evaluate the definite integral. (5x - 8x + 8) dx 8x+8) 0 (5x2 - 8x+8) dx = (Simplify your answer.) 0

-

3. Consider the function defined by: xn f(x) = n!2n(n-1)/2 (b) Evaluate the limit lim n=0 (a) Find the domain of f, i.e. when is the series convergent? f(x) - ex x+0 1 - cos(x)*

-

Approximate the area under the following curve and above the x-axis on the given interval, using rectangles whose height is the value of the function at the left side of the rectangle. (a) Use two...

-

4. Find the critical numbers of the function f(x) = (sin(x)) + cos(x) on the interval 0

-

-------Python Programming------- Hello, please I am trying to perform some Geospatial data analysis Main Goal: I am trying to check for the population density in West Africa. Can you please adapt the...

-

An excerpt from the financial statements of Reitmans (Canada) Limited appears in the table below. Note 18, Commitments in the financial statements provides the following information on the future...

-

A line l passes through the points with coordinates (0, 5) and (6, 7). a. Find the gradient of the line. b. Find an equation of the line in the form ax + by + c = 0.

-

Andrea, who is in the 39.6% tax bracket, is interested in reducing her taxes. She is considering several alternatives. For each alternative listed below, indicate how much tax, if any, she would...

-

Bala and Ann purchased as investments three identical parcels of land over a several-year period. Two years ago they gave one parcel to their daughter, Kim, who is now age 16. They have an offer from...

-

Larry and Sue separated at the end of the year. Larry has asked Sue to sign a joint income tax return for the year because he feels that the tax will be lower on a joint return. Larry and Sue both...

-

Consider the control system in Figure where v(t) is a sinusoidal disturbance, v(t)=sin(t). Compute the absolute value of the sensitivity function at w = 1 rad/s as a function of K. How must K be...

-

ABC Corporation, a growing tech company, decides to raise capital by issuing convertible debt securities. Convertible debt allows bondholders the option to convert their debt into a predetermined...

-

Design Analog and Digital IIR Bandstop filter considering pass band edge1 20kHz, stop band edges 22 kHz & 38kHz, pass band edge2 40kHz, sampling frequency 100kHz. Additionally, draw corresponding...

Study smarter with the SolutionInn App