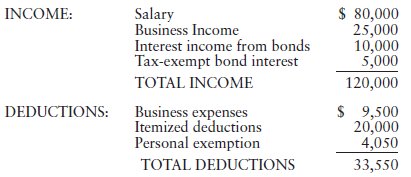

Latesha, a single taxpayer, had the following income and deductions for the tax year 2016: a. Compute

Question:

a. Compute Latesha€™s taxable income and federal tax liability for 2016 (round to dollars).

b. Compute Latesha€™s marginal, average, and effective tax rates.

c. For tax planning purposes, which of the three rates in Part b is the most important?

Transcribed Image Text:

$ 80,000 25,000 10,000 5,000 INCOME: Salary Business Income Interest income from bonds Tax-exempt bond interest TOTAL INCOME 120,000 $ 9,500 20,000 4,050 DEDUCTIONS: Business expenses Itemized deductions Personal exemption TOTAL DEDUCTIONS 33,550

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 84% (13 reviews)

a b Marginal rate 25 From tax rate schedule Average rate 1981 1613481450 ...View the full answer

Answered By

Akshay Singla

as a qualified engineering expert i am able to offer you my extensive knowledge with real solutions in regards to planning and practices in this field. i am able to assist you from the beginning of your projects, quizzes, exams, reports, etc. i provide detailed and accurate solutions.

i have solved many difficult problems and their results are extremely good and satisfactory.

i am an expert who can provide assistance in task of all topics from basic level to advance research level. i am working as a part time lecturer at university level in renowned institute. i usually design the coursework in my specified topics. i have an experience of more than 5 years in research.

i have been awarded with the state awards in doing research in the fields of science and technology.

recently i have built the prototype of a plane which is carefully made after analyzing all the laws and principles involved in flying and its function.

1. bachelor of technology in mechanical engineering from indian institute of technology (iit)

2. award of excellence in completing course in autocad, engineering drawing, report writing, etc

4.70+

48+ Reviews

56+ Question Solved

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

If a single taxpayer had the following stock transactions, what is the amount that would be taxed at the favorable long-term capital gains tax rates? Net short-term gains $5,000 Net short-term losses...

-

Tax Rates. Latesha, a single taxpayer, had the following income and deductions for the tax year 2019: a. Compute Latesha's taxable income and federal tax liability for 2019 (round to dollars and...

-

Tax Rates. Lillian, a single taxpayer, had the following income and deductions for the tax year 2018: INCOME: Salary ....................................................$ 90,000 Business Income...

-

The people on Coral Island buy only juice and cloth. The CPI market basket contains the quantities bought in 2016. The average household spent $60 on juice and $30 on cloth in 2016 when the price of...

-

There are many ways to evaluate the effectiveness of an information system. Discuss each method and describe when one method would be preferred over another method.

-

Read the man page (or Windows equivalent) for the Unix/Windows utility netstat. Use netstat to see the state of the local TCP connections. Find out how long closing connections spend in TIME_WAIT.

-

You are managing a pension fund with a goal of maximizing the long-term growth rate. There are three assets available. Asset 1 has a risk-free return of 5%. Assets 2 and 3 each are driven by...

-

An airplane in flight is subject to an air resistance force proportional to the square of its speed v. But there is an additional resistive force because the airplane has wings. Air flowing over the...

-

Required information [The following information applies to the questions displayed below.] In January, Tongo, Incorporated, a branding consultant, had the following transactions. a. Received $18,400...

-

In distance-vector routing, bad news (increase in a link metric) will propagate slowly. In other words, if a link distance increases, sometimes it takes a long time for all nodes to know the bad...

-

Betty, a married taxpayer, makes the following gifts during the current year (2016): $20,000 to her church, $50,000 to her daughter, and $40,000 to her husband. What is the amount of Bettys taxable...

-

Clay, who was single, died in 2016 and has a gross estate valued at $8,500,000. Six months after his death, the gross assets are valued at $9,000,000. The estate incurs funeral and administration...

-

Is Gary targeting a vulnerable market?

-

CJP, a makes of women's necklaces sells their product direct on their website. The price for a necklace is $100 and their variable cost is $30 for each necklace. They have found an influencer they...

-

The standard cost of maple syrup at Blossom Maple Farms includes 3 hours of direct labor at $12.00 per hour. During August, the company incurs 30,000 direct labor hours at $20 per hour and uses those...

-

Beta sold equipment with a book value of $30,000 for cash of $40,000 and used $15,000 of that cash to purchase new furniture for its sales office. What is the total effect of these two transactions?

-

Small Dog Al Ltd. has fixed costs of $104,000.00 per year, depreciation of $28,000.00 per year, a price per unit of $75.6, and an accounting break-even point of 9,200 units. What are the firm's total...

-

On October 1, 2023, Cicero Inc. (a calendar year end business) loaned Carmy Co. $50,000 cash on a 6-month, 8% note. Interest will be paid at maturity. What amount of interest will Cicero Inc. accrue...

-

If three distinct points A, B, and C in a plane are such that the slopes of nonvertical line segments AB, AC, and BC are equal, then A, B, and C are collinear. Otherwise, they are not. Use this fact...

-

The following T-accounts show postings of selected transactions. Indicate the journal used in recording each of these postings a through e. Cash Accounts Receivable Inventory (d) 500 (e) 300 (b)...

-

Betty, a married taxpayer, makes the following gifts during the current year (2015): $20,000 to her church, $50,000 to her daughter, and $40,000 to her husband. What is the amount of Bettys taxable...

-

Clay, who was single, died in 2015 and has a gross estate valued at $8,500,000. Six months after his death, the gross assets are valued at $9,000,000. The estate incurs funeral and administration...

-

a. Keith Thomas and Thomas Brooks began a new consulting business on January 1, 2015. They organized the business as a C corporation, KT, Inc. During 2015, the corporation was successful and...

-

The fact that restrictive covenants are widely used does not mean, as NanoMech, Inc. v. Suresh shows, that they are always enforceable. NanoMech, Inc. v. Suresh 777 F.3d 1020 (8th Cir. 2015) OPINION...

-

What are the fundamental distinctions between prokaryotic organisms and their eukaryotic counterparts, particularly concerning cellular structure and organizational complexity?

-

What are the structural and biochemical features of prokaryotic cell membranes and cell walls, and how do these components contribute to cellular integrity, homeostasis, and environmental...

Study smarter with the SolutionInn App