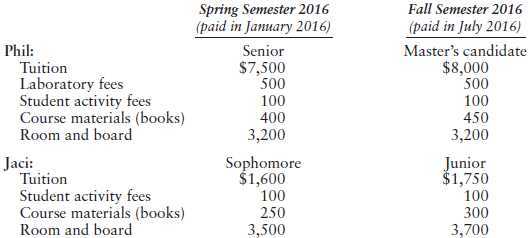

Lou and Stella North are married, file a joint return, and have two dependent children in college,

Question:

a. Compute any education credits that the Norths may claim in 2016.

b. How would your answer in Part a change if Phil received an academic scholarship of $3,000 (excluded from gross income) for each semester in 2016?

c. How would your answer in Part a change if Lou and Stella€™s modified AGI for 2016 was $175,000?

d. How would your answer in Part a change if Phil had been a junior during Spring semester 2016 and a senior during Fall semester 2016?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: