Mike and Linda are a married couple who file jointly. They have three dependent children who are

Question:

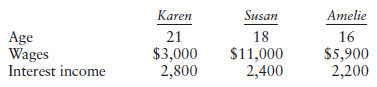

Compute each child€™s tax.

Transcribed Image Text:

Karen 21 $3,000 2,800 Susan Amelie 16 Age Wages Interest income 18 $11,000 $5,900 2,200 2,400

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (9 reviews)

Karen Karens gross tax is 371 At age 21 Karen is subject to the kiddie tax because she is a fulltime student who earned less than onehalf of her own s...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax table 3.5. Assume that their taxable income this year was $309,000. Round your...

-

Joe and Jane Keller are a married couple who file a joint income tax return. The couple's taxable income was $102,000. How much federal taxes did they owe? Use the tax tables given in the chapter.

-

Joe and Jane Keller are a married couple who file a joint income tax return, where the tax rates are based on the tax tables presented in the chapter. Assume that their taxable income this year was...

-

The following scatter plot indicates that 200 150 > 100 50 0 0 20 X 40 O a log x transform may be useful Oa y transform may be useful a x transform may be useful Ono transform is needed Oa 1/x...

-

What is reengineering? What are the potential benefits of performing a process redesign?

-

Draw a timeline diagram for the sliding window algorithm with SWS = RWS = 4 frames in the following two situations. Assume the receiver sends a duplicate acknowledgment if it does not receive the...

-

Let \(q(t)\) be the survival probability and let \(q^{-1}\) be its inverse function. Also, let \(U\) be a uniform random variable on \([0,1]\). For each realization \(u\), let \(\tau\) be chosen such...

-

A business issued a 45-day, 6% note for $80,000 to a creditor on account. Journalize the entries to record (a) The issuance of the note and (b) The payment of the note at maturity, including interest.

-

Consider SELECT statements listed below. SELECT L_PARTKEY, L_TAX, COUNT(*) FROM LINEITEM GROUP BY L PARTKEY, L_TAX; SELECT O TOTALPRICE, COUNT(*) FROM ORDERS GROUP BY O TOTALPRICE; SELECT L_TAX,...

-

Draw an ERD for each of the following situations. (If you believe that you need to make additional assumptions, clearly state them for each situation.) Draw the same situation using the tool you have...

-

In 2016, Lana, a single taxpayer with AGI of $85,400, claims exemptions for three dependent children, all under age 17. What is the amount of her child credit?

-

Matt and Sandy reside in a community property state. Matt left home in April 2016 because of disputes with his wife, Sandy. Subsequently, Matt earned $15,000. Before leaving home in April, Matt...

-

The traditional training approach is meant to remove a deficit. The use of social media in training can shift the impact of training to supporting performance. Which approach do you think is better?...

-

The car's tires have a radius of = 13" = 33 cm and the tires do not slip. 2. What is a correct setup to calculate the angular acceleration of the car tires

-

A 25 kg boy is riding a merrry go round with a radius of 5 m what is the acceleration if his tangential speed is 6m/ s

-

A stratum of clean sand and gravel between two channels has a hydraulic conductivity K =10-1 cm/sec and is supplied with water from a ditch (h0 = 9 ft deep) that penetrates to the bottom of the...

-

If a plane is climbing at an angle of 15 above the horizontal and its shadow moves across the ground at 200.0 km/h [FWD] when the sun is directly overhead, what is the plane's actual velocity? How...

-

If a spaceship is approaching you at a speed of .75 the speed of light, what is the new wavelength for a blue laser that's shown at you? (assume the wavelength as viewed by the rest frame of the...

-

Determine whether each function is even, odd, or neither. (x) = -x 3 + 2x

-

For the following exercises, find the inverse of the function and graph both the function and its inverse. f(x) = 4 x 2 , x 0

-

Wes and Tina are a married couple and provide financial assistance to several persons during the current year. For the situations below, determinewhether the individuals qualify as Wes and Tinas...

-

John and Carole file a joint return and have three children: Jack, age 23; David, age 20; and Kristen, age 15. All three children live at home the entire year. Below is information about each of the...

-

Robert provides much of the support for his daughter, Jane, and her two children. Jane earned $20,000. Robert, whose AGI is $350,000, paid the rent of $11,000 on Janes apartment and provided an...

-

blem 3: Consider the soil profile below. If the effective stress at point C is 111 kPa, find the value of h. (30) e=0.61 Gs=2.66 Ground Surface 4m 5m e=0.48 Gs=2.67 A PP A

-

Q4 (40 marks). Two identical rigid foundations are given. Calculate the differential settlement ratio (8/L) after 100 days and long term after construction of the foundations. Hint: Average total...

-

An embankment is given (H = 5 m and y = 20 kN/m). Determine the vertical stress increase at points A, which is 5 m below the ground surface. Assume the embankment is constructed on the ground...

Study smarter with the SolutionInn App