Stan Bushart works as a customer representative for a large corporation. Stan's job entails traveling to meet

Question:

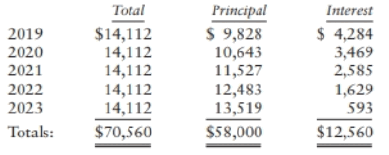

Stan Bushart works as a customer representative for a large corporation. Stan's job entails traveling to meet with customers, and he uses his personal car 100% for business use. In 2019, Stan must decide whether to buy or lease a new car. After bargaining with several car dealers, Stan has agreed to a price of $58,000. If he buys the car, he will borrow the entire $58,000 at an 8% annual interest rate, and his payments will be $1,176.03 per month over 60 months. Annual principal and interest payments are:

If he leases the car, his lease payment will be $870 per month for 60 months. At the end of the lease, he has the option of purchasing the car for $10,000. Stan's marginal tax rate is 24% in each of the five years. Using present value analysis with an 8% discount rate, is Stan better off leasing or buying the car?

If Stan purchases the car, he will not claim Sec. 179 expensing or bonus depreciation and will sell the car for $10,000 at the end of five years. If he leases the car, assume he merely turns the car in at the end of the lease.

Step by Step Answer:

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse