Wayne is single and has no dependents. Without considering his $11,000 adjusted net capital gain (ANCG), his

Question:

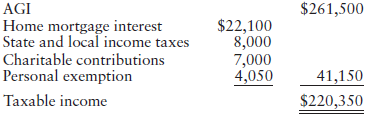

a. What is Wayne€™s tax liability without the ANCG?

b. What is Wayne€™s tax liability with the ANCG?

Transcribed Image Text:

$261,500 AGI Home mortgage interest $22,100 State and local income taxes Charitable contributions Personal exemption Taxable income 8,000 7,000 4,050 41,150 $220,350

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

a 56115 4664375 33 x 220350 191650 b Total tax of 58425 58007 Medicare tax on net inve...View the full answer

Answered By

BETHUEL RUTTO

Hi! I am a Journalism and Mass Communication graduate; I have written many academic essays, including argumentative essays, research papers, and literary analysis. I have also proofread and written reviews, summaries and analyses on already finished works. I am eager to continue writing!

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Eric is single and has no dependents for 2020. He earned $60,000 and had deductions from gross income of $1,800 and itemized deductions of $12,600. Compute Erics income tax for the year using the Tax...

-

11) S'well manufactures and sells high quality, insulated water bottles made of stainless steel, in many fun colors and designs. S'well sells its water bottles to retail stores such as high-end...

-

Robert A. Kliesh, age 41, is single and has no dependents. Robert's Social Security number is 111-11-1111. His address is 201 Front Street, Missoula, MT 59812. He is independently wealthy as a result...

-

Prepare journal entries to record each of the following transactions. The company records purchases using the gross method and a perpetual inventory system. June 1 9 Purchased merchandise with a...

-

Compute the 1- energy content of the signal vo (t) in Problem 14.38 in the frequency range from = 2 to = 4 rad/s.

-

Suppose you have accumulated a credit card balance of $800, at an annual interest rate of 10 percent. You are also planning to open a new savings account that accumulates interest at an annual rate...

-

What are the disadvantages of nonprobability sampling techniques?

-

Danielle Neylon has trouble keeping her debits and credits equal. During a recent month, Danielle made the following accounting errors: a. In preparing the trial balance, Danielle omitted a $7,000...

-

(a) Explain the loop problem. Apply Spanning Tree Protocol (STP) in the following network diagram to solve the loop Problem. Find out the Root Bridge, root ports, designated bridge, designated ports,...

-

There are 2 shinobis with chakra levels 5 and 10 respectively and the desired sum of chakra levels is utmost 15 Starting with ke0, suy of chakra levels after attack max(5-0,0) + max(10- 0,0) 5+10 15....

-

Donna files as a head of household in 2017 and has taxable income of $90,000, including the sale of a stock held as an investment for two years at a gain of $20,000. Only one asset was sold during...

-

An investor in a 28% tax bracket owns land that is a capital asset with a $50,000 basis and a holding period of three years. The investor wishes to sell the asset at a price high enough so that he...

-

Modern consumer appliances such as stereos and digital cameras often have a display where commands can be entered and the results of entering those commands can be viewed. These devices often have a...

-

John Doe has decided to clone himself. He is sterile. He cannot find anyone to marry him. He wishes to have children. He knows that he will not be able to love a child who is adopted or not connected...

-

There was considerable criticism levied against all levels of government in the aftermath of Hurricane Katrina. In particular, many observers viewed the governmental response as both slow and...

-

Discuss in terms of the processes for each one or how it works? When is each framework used -- business purpose for its use? Discuss in detail each framework's advantages and disadvantages? Which...

-

In March 2020, Annie Aroosa a third-year student studying Management and Finance at Northeastern University, accepted a internship/coop position in the Accounting Department at one of the major...

-

Many governments have signed up to a succession of protocols or agreements on sustainable development. Although many construction projects consider sustainability as a critical project objective,...

-

What is the effect of the post-box rule and when does it apply? To what forms of communications does it apply?

-

Before the latest financial crisis and recession, when was the largest recession of the past 50 years, and what was the cumulative loss in output over the course of the slowdown?

-

Refer to the preceding problem. In preceding problem Carls tax liability for last year was $19,000, and his AGI did not exceed $150,000. Carl requests an automatic extension for filing his current...

-

Assume that Ed expects his income for this year to decline and his tax liability for this year to be only $15,000. What minimum amount of estimated taxes should Ed pay this year? What problems will...

-

Pams prior year (Year 1) income tax liability was $23,000. Her current year (Year 2) AGI did not exceed $150,000. On April 2 of next year (Year 3), Pam, a calendar year taxpayer, timely files her...

-

Consider the control system in Figure where v(t) is a sinusoidal disturbance, v(t)=sin(t). Compute the absolute value of the sensitivity function at w = 1 rad/s as a function of K. How must K be...

-

ABC Corporation, a growing tech company, decides to raise capital by issuing convertible debt securities. Convertible debt allows bondholders the option to convert their debt into a predetermined...

-

Design Analog and Digital IIR Bandstop filter considering pass band edge1 20kHz, stop band edges 22 kHz & 38kHz, pass band edge2 40kHz, sampling frequency 100kHz. Additionally, draw corresponding...

Study smarter with the SolutionInn App