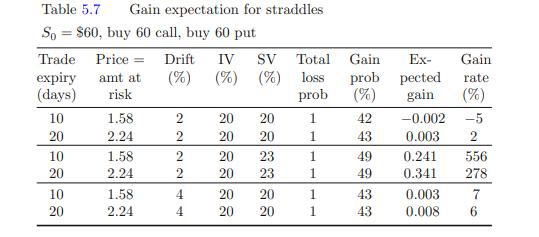

Question: Analyze the straddle strategy as in Table 5.7. Data given in table 5.7 Table 5.7 Gain expectation for straddles So $60, buy 60 call, buy

Analyze the straddle strategy as in Table 5.7.

Data given in table 5.7

Table 5.7 Gain expectation for straddles So $60, buy 60 call, buy 60 put Trade Price = Drift IV SV Total Gain amt at (%) (%) (%) loss risk prob expiry (days) 10 20 10 20 10 20 1.58 2.24 1.58 2.24 1.58 2.24 22 22 4 Hi H 4 20 20 20 20 20 20 20 20 23 23 20 20 1 1 1 1 Ex- prob pected gain 1 1 42 43 49 49 43 43 -0.002 0.003 Gain rate (%) 0.003 0.008 -5 2 0.241 556 0.341 278 7 6

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

A straddle strategy involves purchasing a call and a put option on the same underlying asset with the same expiration date and at the same strike pric... View full answer

Get step-by-step solutions from verified subject matter experts