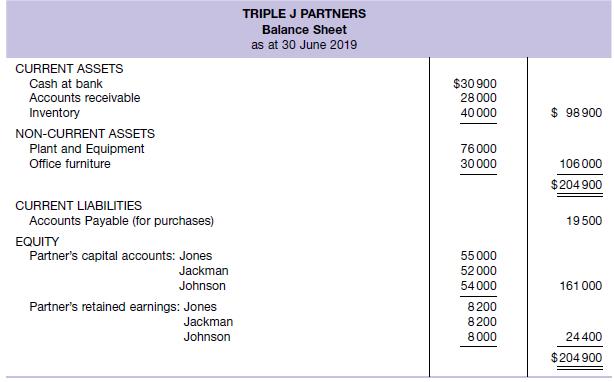

Jones, Jackman and Johnson are partners in the consulting firm of Triple J Partners. The balance sheet

Question:

Jones, Jackman and Johnson are partners in the consulting firm of Triple J Partners. The balance sheet of the partnership as at 30 June 2019 is set out below.

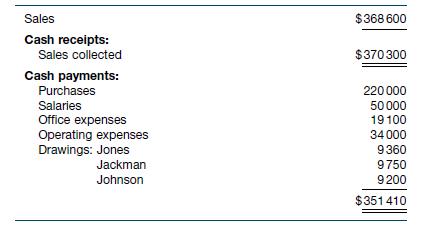

It was agreed that all profits would be divided equally between the partners. Business transactions for the year were as follows (ignore GST).

Inventory at 30 June 2020 was $38 700 and Accounts Payable was $18 000. Non‐current assets are depreciated at 10% p.a.

Required

(a) Prepare the income statement for the year ended 30 June 2020.

(b) Prepare the statement of changes in partners’ equity for the year ended 30 June 2020.

(c) Prepare the balance sheet as at 30 June 2020.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield