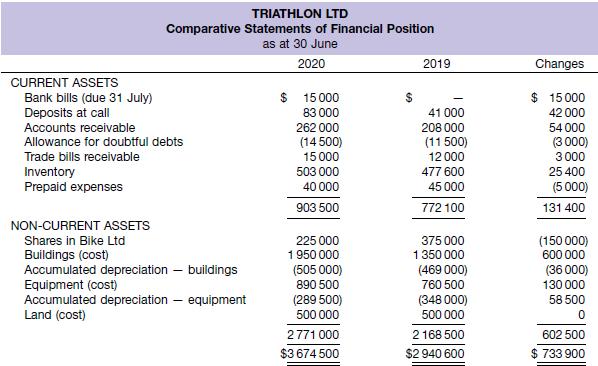

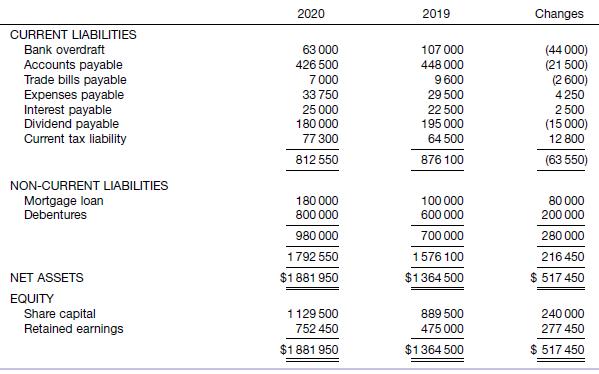

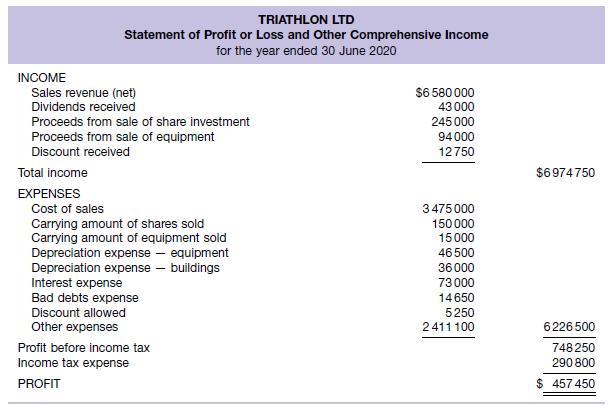

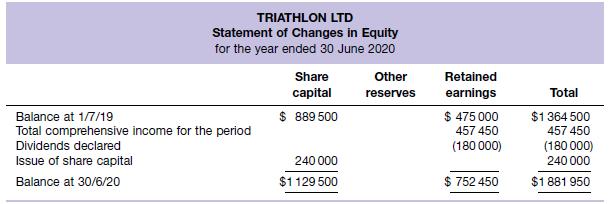

The financial statements of Triathlon Ltd are provided below. Additional information During the year ended 30 June

Question:

The financial statements of Triathlon Ltd are provided below.

Additional information During the year ended 30 June 2020, Triathlon Ltd entered into the following transactions relevant to the preparation of the statement of cash flows.

1. Building additions were completed at a cost of $600 000 cash.

2. New equipment was purchased at a cost of $250 000; $150 000 was paid in cash and the balance covered by arranging a long‐term mortgage loan with Running Finance Ltd.

3. Equipment with a cost of $120 000 and accumulated depreciation of $105 000 was sold for $94 000 cash.

4. Shares in Bike Ltd were sold for $245 000 cash.

5. Debentures (9%) were issued at nominal value for cash, $200 000.

6. An additional 40 000 ordinary shares were issued for cash for $6 per share.

7. A cash dividend of $195 000 was paid during the year.

8. $20 000 of mortgage due 30 June 2020 was repaid during the year.

9. The company pays tax in four instalments, and the first three instalments have been paid in relation to the current year.

10. The bank overdraft facility is used as part of the company’s everyday cash management facilities.

Required

(a) Prepare a statement of cash flows in accordance with accounting standards using the direct method.

(b) Prepare notes to the statement to (1) reconcile cash at end shown in the statement of cash flows to the figures in the statement of financial position and (2) reconcile the net cash from operating activities to profit.

(c) Comment on the company’s cash flows during the year ended 30 June 2020 and cash position at 30 June 2020.

(d) Discuss whether accounting standards should allow the option to prepare the statement of cash flows using the direct or indirect method.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield