The following information is used to calculate Cleaning Capers Ltds payroll for the week ending 30 June

Question:

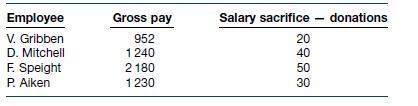

The following information is used to calculate Cleaning Capers Ltd’s payroll for the week ending 30 June 2020.

Employees’ superannuation contribution is 9% of their gross pay. PAYG tax is taken out at 30% after subtracting the donations and superannuation. All employees also have the following deductions from their after‐tax pay: 3.5% life insurance and 10% medical insurance.

Required

(a) Calculate ‘take‐home’ pay for each employee.

(b) Prepare a general journal entry to accrue the payroll and associated deductions.

(c) Prepare a cash payments journal entry to record the payment of wages.

(d) Assume that, on 6 July 2020, the company forwarded cheques to cover amounts withheld from employees’ wages for the month of June. Total income tax deductions were $6040. Other deduction liabilities were four times the total weekly deductions. Prepare a cash payments journal entry to record these payments.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield