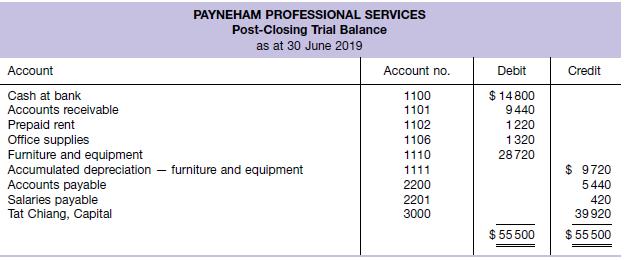

The postclosing trial balance at 30 June 2019 of Payneham Professional Services is shown below. Transactions completed

Question:

The post‐closing trial balance at 30 June 2019 of Payneham Professional Services is shown below.

Transactions completed during the year ended 30 June 2020 are summarised below.

1. Collections on accounts receivable totalled $82 060.

2. Consulting fees of $88 150 were receivable during the year. Clients are invoiced after services are provided and are given 30 days in which to pay.

3. Rent paid in advance was $14 580.

4. Office supplies were purchased during the year for $380 in cash and $420 on credit.

5. Tat withdrew $25 000 for private use.

6. Salary payments amounted to $31 940, of which $420 was for salaries accrued to the end of the year ending 30 June 2020.

7. Advertising totalling $3360 was purchased on credit.

8. Electricity expense of $3600 was paid.

9. Accounts payable of $2880 were paid. The following additional information should be considered for adjusting entries.

10. Unused office supplies on hand at the end of the year totalled $760.

11. Depreciation on the furniture and equipment is $4600.

12. Salaries earned but not paid amount to $1180.

13. Rent paid in advance in transaction 3. Rent for 6 months of $7290 was paid in advance on 1 August and 1 February.

Required

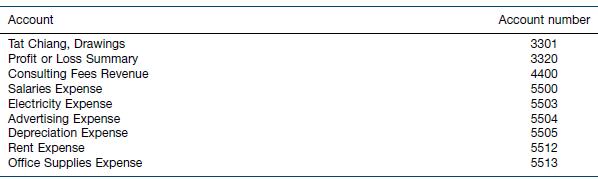

(a) Prepare the ledger of Payneham Professional Services by opening T accounts for the accounts listed in the post‐closing trial balance and for the accounts listed below. Post the 30 June 2019 balances.

(b) Prepare journal entries to record the transactions numbered 1–9.

(c) Post the entries to the T accounts.

(d) Journalise and post the adjusting entries.

(e) Prepare a 10‐column worksheet for the year ended 30 June 2020.

(f) Prepare an income statement, a statement of changes in equity and a balance sheet.

(g) Journalise and post the closing entries.

(h) Prepare a post‐closing trial balance.

(i) Prepare any suitable reversing entries on 1 July 2020.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield