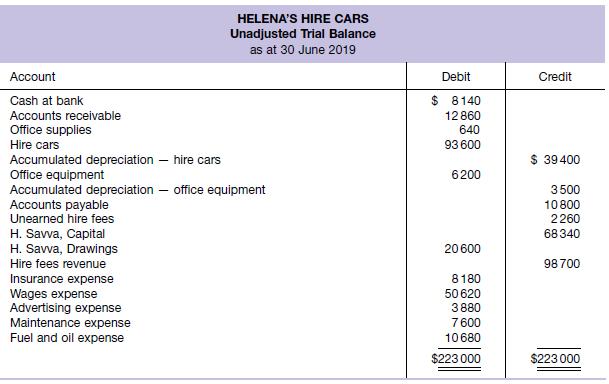

The unadjusted trial balance of Helenas Hire Cars is shown below (ignore GST). Additional information 1. Petrol

Question:

The unadjusted trial balance of Helena’s Hire Cars is shown below (ignore GST).

Additional information

1. Petrol purchased on credit for $680 and used during the last week in June has not been paid for or recorded.

2. A physical count showed office supplies totalling $340 were still on hand at 30 June.

3. Depreciation for 1 year on the hire cars is $12 400. Depreciation on the office equipment is $980.

4. The balance in the Advertising Expense account includes $600 prepayment for an advertising campaign beginning in July.

5. The balance in the Unearned Hire Fees account includes $1800 received in May for hire services completed in June.

6. The June insurance premium of $700 is overdue and has not been recorded. A tax invoice has not been received.

7. Wages earned but not paid amounted to $1150.

Required

(a) Prepare a 10‐column worksheet for the year ended 30 June 2019.

(b) Prepare the income statement for the business for the year ended 30 June 2019.

(c) Prepare a statement of changes in equity for the year ended 30 June 2019.

(d) Prepare a balance sheet as at 30 June 2019.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield