Vinay Sanja was interviewing for a job at the State Bank of India. The bank requires all

Question:

Vinay Sanja was interviewing for a job at the State Bank of India. The bank requires all job applicants to take a competency test on basic money mathematics. Vinay has completed the interest calculations portion of the exam. Below are his questions and answers. Vinay must correctly answer in at least 3 cases to be eligible for the job. Evaluate and correct Vinay's answers. Does he qualify for the job?

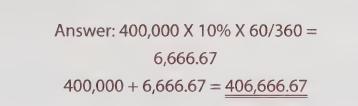

(a) Assume the bank holds a 400,000 Indian Rupee (INR) note receivable dated June 1, 20X1. This note matures on August 31, 20X1. This note is written to assume a 360 day year and 30 day months. The annual interest rate is stated at 10%. What is the maturity value of the note, including interest?

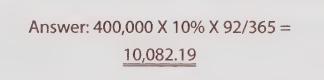

(b) Assume the bank holds a INR 400,000 note receivable dated June 1, 20X1. This note matures on August 31, 20X1. This note is written to assume a 365 day year and actual days outstanding are used in all calculations. The annual interest rate is stated at 10%. What is the maturity value of the note, including interest?

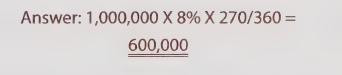

(c) Assume the bank holds a INR 1,000,000 note receivable dated October 1, 20X5. This note matures on September 30, 20X6. This note is written to assume a 360 day year and 30 day monthsT.he annual interest rate is stated at 8%. How much interest income should the bank record for its accounting year ending December 31, 20X5?

![]()

(d) Assume the bank holds a INR 1,000,000 note receivable dated October 1, 20X5. This note matures on September 30, 20X6. This note is written to assume a 360 day year and 30 day months. The annual interest rate is stated at 8%. How much interest income should the bank record for its accounting year ending December 31, 20X6?

Step by Step Answer: