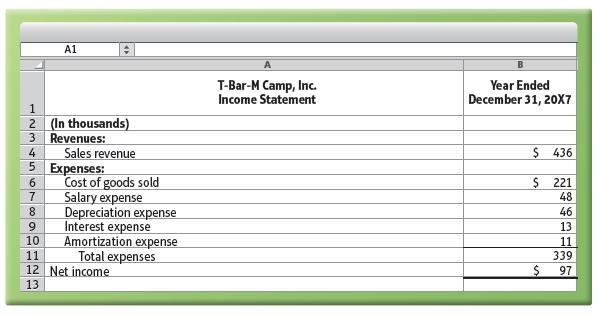

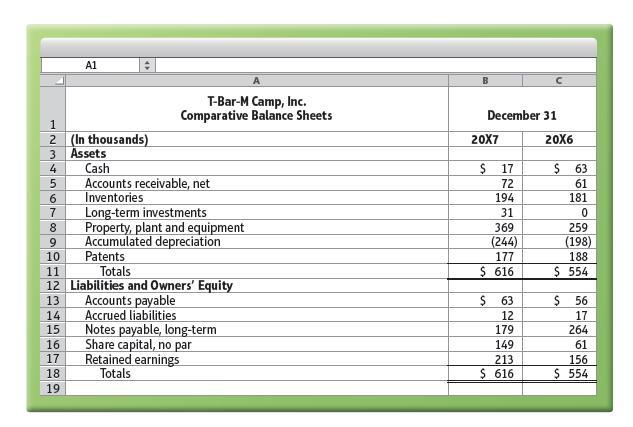

Question: Case 1. (Learning Objectives 3, 4, 5: Preparing and using the statement of cash flows to evaluate operations) The 20X7 Income Statement and the 20X7

Case 1. (Learning Objectives 3, 4, 5: Preparing and using the statement of cash flows to evaluate operations) The 20X7 Income Statement and the 20X7 comparative Balance Sheet of T-Bar-M Camp, Inc., have just been distributed at a meeting of the camp’s board of directors.

The directors raise a fundamental question: Why is the cash balance so low? This question is especially troublesome since 20X7 showed record profits. As the controller of the company, you must answer the question.

Requirements 1. Prepare a statement of cash flows for 20X7 in the format that best shows the relationship between net income and operating cash flow. The company sold no PPE or long-term investments and issued no notes payable during 20X7. There were no noncash investing and financing transactions during the year. Show all amounts in thousands.

2. Answer the board members’ question: Why is the cash balance so low? Point out the two largest cash payments during 20X7. (Challenge)

3. Considering net income and the company’s cash flows during 20X7, was it a good year or a bad year? Give your reasons.

A1 2 (In thousands) Revenues: Sales revenue 5 Expenses: 1234567890123 Cost of goods sold Salary expense Depreciation expense Interest expense Amortization expense Total expenses 12 Net income T-Bar-M Camp, Inc. Income Statement Year Ended December 31, 20X7 $ 436 $ 221 48 46 13 11 339 $ 97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts