Question: Case 3. (Learning Objective 3: Determining allowance for doubtful receivables using the aging method, with and without additional information about loss events) Two accounting interns,

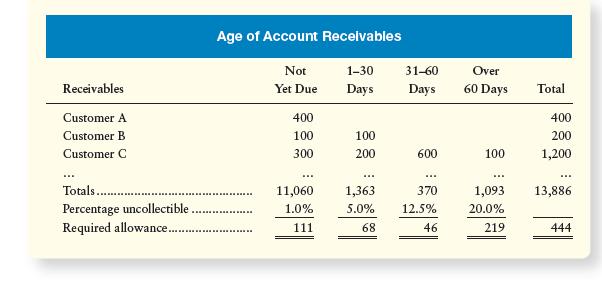

Case 3. (Learning Objective 3: Determining allowance for doubtful receivables using the aging method, with and without additional information about loss events) Two accounting interns, Serene and Joel, were tasked by you, their supervisor, to propose the required amount of allowance at December 31, 20X7, for Alyssa Candy Empire (ACE), a distributor of specialty confectionery. Data provided to the two interns include an aging schedule below:

Serene evaluated ACE’s historical records of customer defaults and concluded that the likelihood of a receivable becoming bad is correlated to the age of the receivable. She assigned a 1%, 5%, 10%, and 20% likelihood for each age group of receivables.

Joel took another approach and evaluated the likelihood of receivable impairment customer by customer. His research shows that Customer A is a new customer and since it is not yet overdue, there is only a 1% chance that it will not be collected. Customer B and Customer D are long-time customers, and whilst they may pay a little later than the usual credit term of 30 days, the likelihood of not being able to collect their receivables is only 10%. Joel has read that Customer C was not able to make its loan repayments last month. Newspaper articles also point to some worry about Customer C’s ability to continue as a growing concern.

Joel estimated that it is almost certain that the amount owing would be uncollectible. Customer E, located in another country, has also experienced significant decline in business due to a severe recession in the country. Joel believes that there is a 20% chance that the receivables may be impaired.

Joel and Serene performed their analysis and reported back to you with their recommendations.

Whose recommendation will you accept? Why?

Age of Account Receivables Not 1-30 31-60 Over Receivables Yet Due Days Days 60 Days Total Customer A 400 400 Customer B 100 100 200 Customer C 300 200 600 100 1,200 Totals... 11,060 1,363 370 1,093 13,886 Percentage uncollectible. 1.0% 5.0% 12.5% 20.0% Required allowance.. 111 68 46 219 444

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts