Question: E3-44. (Learning Objectives 3, 4: Computing financial statement amounts) The accounts of Gretel Company prior to the year-end adjustments follow. Adjusting data at the end

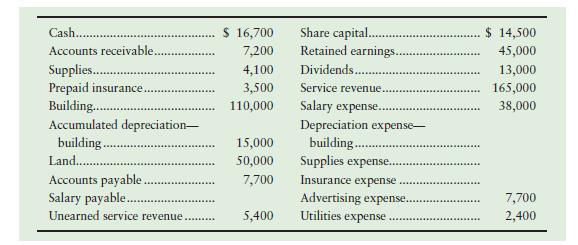

E3-44. (Learning Objectives 3, 4: Computing financial statement amounts) The accounts of Gretel Company prior to the year-end adjustments follow.

Adjusting data at the end of the year include which of the following?

a. Unearned service revenue that has been earned, $1,820

b. Accrued service revenue, $34,000

c. Supplies used in operations, $3,400

d. Accrued salary expense, $3,300

e. Prepaid insurance expired, $1,400

f. Depreciation expense—building, $2,500 Hansel Lacourse, the principal shareholder, has received an offer to sell Gretel Company. He needs to know the following information within one hour:

a. Net income for the year covered by these data

b. Total assets

c. Total liabilities

d. Total shareholders’ equity

e. Proof that Total assets = Total liabilities + Total shareholders’ equity after all items are updated.

Requirement 1. Without opening any accounts, making any journal entries, or using a work sheet, provide Mr. Lacourse with the requested information. The business is not subject to income tax.

Cash.. $ 16,700 Accounts receivable. 7,200 Share capital.. Retained earnings... $ 14,500 45,000 Supplies.......... 4,100 Dividends...... 13,000 Prepaid insurance. 3,500 Service revenue. 165,000 Building... 110,000 Salary expense. 38,000 Accumulated depreciation- Depreciation expense- building. 15,000 building.. Land.......... 50,000 Supplies expense.. Accounts payable. 7,700 Insurance expense Salary payable..... Advertising expense. 7,700 Unearned service revenue. 5,400 Utilities expense 2,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts