In BE2-2, Caterpillar's current assets consisted primarily of cash and short-term investments of $8.3 billion, accounts receivable

Question:

In BE2-2, Caterpillar's current assets consisted primarily of cash and short-term investments of $8.3 billion, accounts receivable of $17.9 billion, inventory of $11.1 billion, and miscellaneous current assets of $1.7 billion.

a. Does the company appear able to meet its current liabilities as they come due? Why or why not?

b. Can Caterpillar pay off its current liabilities with liquid assets?

c. Would it be more or less able to meet its current liabilities if the dollar amounts in accounts receivable (payments due from customers) and inventory were reversed?

BE2-2

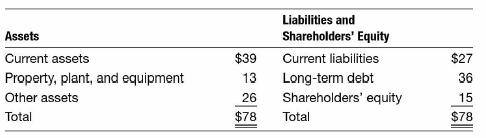

A summary of a recent balance sheet for Caterpillar is as follows (dollars in billions):

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: