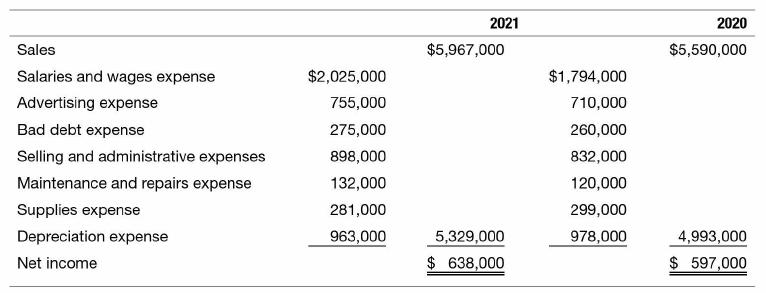

Lynch Engineering Firm provided the following income statement for 2021 in its annual financial report: 1. The

Question:

Lynch Engineering Firm provided the following income statement for 2021 in its annual financial report:

1. The company declared and paid a dividend of $550,000 in 2020 but did not declare any dividends in 2021.

2. 2020:

(a) 35 percent of the sales were on account.

(b) The accounts receivable balance decreased by $2,980,000 from January 1 to December 31.

(c) As of December 31, the company still owed $145,000 in wages and $67,000 on the supplies used during the year.

3. 2021:

(a) 75 percent of the sales were on account.

(b) The accounts receivable balance increased by $1,671,750 from January 1 to December 31.

(c) As of December 31, the company still owed $25,000 in salaries and wages and $50,000 in advertising.

(d) On January 1, 2020, the company had a balance of $13,245 in cash.

4. The company had no write-offs or recoveries of accounts receivable during 2020 or 2021.

INSTRUCTIONS:

a. Prepare the operating section of the statement of cash flows for 2020 and 2021, using the direct method.

b. Assume that you are a member of the board of directors of the Lynch Engineering Firm. Several influential shareholders have called you and complained that the company generated more net income in 2021 than in 2020, yet chose not to declare a dividend in 2021. How would you explain the board's position on dividends in 2020 versus 2021?

Step by Step Answer: