OBrien Industries Inc. is a book publisher. The partial balance sheets for December 31, 20Y4 and 20Y5

Question:

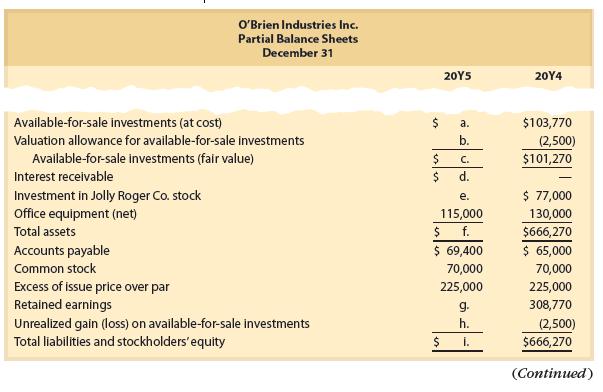

O’Brien Industries Inc. is a book publisher. The partial balance sheets for December 31, 20Y4 and 20Y5 are as follows:

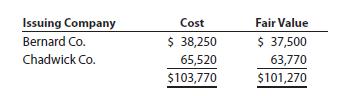

The available-for-sale investments at cost and fair value on December 31, 20Y4, are as follows: The investment in Jolly Roger Co. stock represents 30% of the outstanding shares of Jolly Roger Co.

The investment in Jolly Roger Co. stock represents 30% of the outstanding shares of Jolly Roger Co.

The following selected transactions occurred during 20Y5:

Jan. 2. Purchased $94,400 of Gozar Inc. 5%, 10-year bonds at 100. The bonds are classified as an available-for-sale investment. The bonds pay interest on June 30 and December 31.

June 30. Received interest for 6 months on the Gozar Inc. bonds purchased on January 2.

Oct. 1. Purchased $40,000 of Nightline Co. 6%, 10-year bonds at 100. The bonds are classified as an available-for-sale investment. The bonds pay interest on October1 and April 1.

9. Dividends of $12,500 are received on the Jolly Roger Co. investment.

Dec. 31. Jolly Roger Co. reported a total net income of $112,000 for 20Y5, which O’Brien Industries Inc. recorded using the equity method.

31. Received interest for 6 months on the Gozar Inc. bonds purchased on January 2.

31. Accrued 3 months of interest on the Nightline bonds.

31. Adjusted the available-for-sale investment portfolio to fair value, using the following fair values:

Issuing Company Fair Value

Bernard Co. $34,650

Chadwick Co. 57,960

Gozar Inc. 98,560

Nightline Co. 39,200

For the year ending December 31, 20Y5, O’Brien Industries Inc. reported net income of $148,230 and paid no dividends.

Instructions

Determine the missing amounts by letter in the partial balance sheets.

Step by Step Answer:

Financial Accounting

ISBN: 9781337913102

16th Edition

Authors: Carl S. Warren, Christine Jonick, Jennifer Schneider