Apple Inc., is one of the most successful enterprises of all time. Its computers, tablets, phones, and

Question:

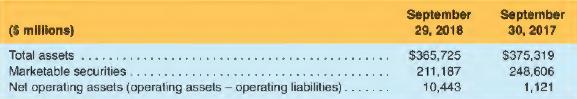

Apple Inc., is one of the most successful enterprises of all time. Its computers, tablets, phones, and watches are all highly desired by consumers, and the company's product innovations keep arriving at a steady pace. Apple's financial success can also be attributed to its supply chain management and to its management of its income taxes. Historically, U.S. income taxes have been based on payments from Apple's international subsidiaries, so the company (and many others) could defer the payment of taxes by retaining profits in its international subsidiaries and investing in relatively safe, liquid financial assets. As a result, Apple's balance sheet reports substantial investments in marketable securities, as shown in the following:

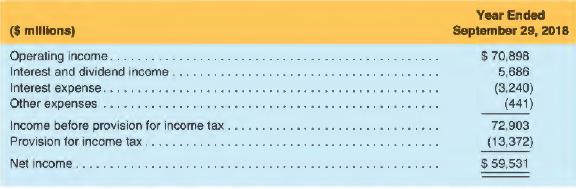

The following information is taken from the company's fiscal 2018 income statement and footnotes:

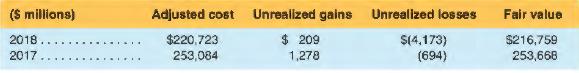

finally, the following table is taken from Note 2 of Apple's 2018 10-K annual report. The reported numbers are slightly higher than those reported from Apple's balance sheet above because some AFS securities are classified as cash equivalents on the balance sheet, rather than marketable securities. Fixed-income (debt) investments-AFS:

REQUIRED:

a. Calculate Apple's return on assets for fiscal year 2018. Assume an income tax rate of 25%.

b. Calculate Apple's RNOA for 2018. (Refer to Appendix A of Chapter 5 for further discussion.) What factors contribute to this RNOA?

c. What method does Apple use to account for its fixed-income investments? What value is included in its 2018 balance sheet?

d. From its balance sheet, it would appear that a significant portion of Apple's resources are devoted to investing in financial instruments. Calculate the after-tax return to Apple's financial assets. Apple's Statement of Other Comprehensive Income reports an after-tax unrealized holding loss on AFS investments equal to $3,407 million? What would have been Apple's return to financial investments if it had used the trading security method for these investments?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman