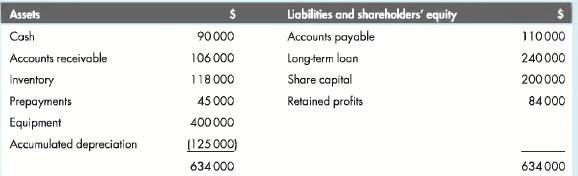

Below is the abridged balance sheet for Newcombe Ltd as at 31 May 2016. The following transactions

Question:

Below is the abridged balance sheet for Newcombe Ltd as at 31 May 2016.

The following transactions occur during June:

a. Received $23 000 from accounts receivable,

b. Additional shares worth $80 000 are issued,

c. Inventory (costing $32 000) is sold on credit for $76 000.

d. Recognition of $4000 of depreciation expense,

e. Of the loan, $60 000 is repaid,

f . Administrative expenses of $7000 are paid,

g. A total of $9000 of prepayments are used up.

h. Payment of wages of $ 13 000.

i. Purchase of $28 000 worth of inventory for cash,

j. Dividends of $6000 are paid,

k. Payment of $36 000 of accounts payable.

Required:

1. Show the effect of each of the above transactions on the accounting equation.

2. Prepare an income statement for the month of June and a balance sheet for Newcombe Ltd at 30 June 2016.

3. For each of the above transactions, what is the effect on net profit, total assets, total liabilities and shareholders' equity? Write 'increase', 'decrease' or 'no effect' for each transaction.

4. Prepare journal entries for each of the 11 transactions above.

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson