In its June 30, 2018, balance sheet, Microsoft Corporation reports an investment in available for-sale fixed- income

Question:

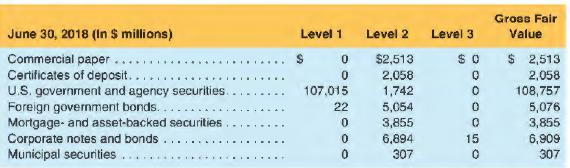

In its June 30, 2018, balance sheet, Microsoft Corporation reports an investment in available for-sale fixed- income (debt) securities with a value of $ 129,475. As available-for-sale securities, these investments are reported at their fair value, and Microsoft provides the following information in its footnotes.

a. Explain the differences between the three columns labeled Level 1, Level 2, and Level 3.

b. Are all of these investments "marked-to-fair value"? If not, which ones are not marked-to-fair value? Which investment values do you regard as most subjective? Least subjective?

c. If Microsoft needed to raise cash to take advantage of an investment opportunity, which of these investments do you regard as most liquid (i.e., most easily turned into cash)? Least liquid?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman