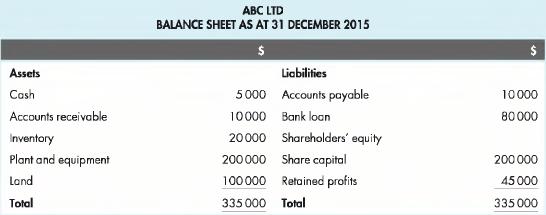

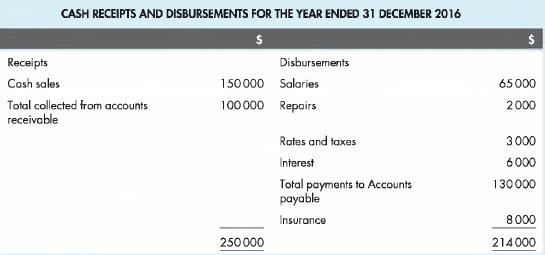

The balance sheet of ABC Ltd as at 31 December 2015 and the cash receipts and payments

Question:

The balance sheet of ABC Ltd as at 31 December 2015 and the cash receipts and payments for the year ended 31 December 2016 are shown below.

Additional information:

a. As at 31 December 2016, the balance of accounts receivable was $25 000 and the balance of accounts payable was $15 000.

b. Salaries are now paid monthly on the second of the month for the preceding month. Wages and salaries total $7000 for the month of December. This was paid on 2 January 2017.

c. Plant and equipment is shown net of accumulated depreciation of $50 000. Depreciation expense for the year is calculated using the straight-line method at 10 percent per annum.

d. The bank loan accrues interest at a rate of 10 percent per annum, payable on 30 March and 30 September. The loan was taken out on 31 December 2015.

e. A physical stocktake, as at 31 December 2016, revealed that inventory costing $23 000 was on hand. Cost of goods sold for the year was calculated as

$132 000.

f. The insurance premium of $8000 provides cover for the year ended 30 September 2017.

Required:

1. Calculate the following:

a. Total sales for the period

b. Gross profit

c. Salaries expense and accrued salaries

d. Interest expense and accrued interest

e. Insurance expense and prepaid insurance.

2. What was the profit/(loss) for the period?

3. Prepare the balance sheet as at 31 December 2016.

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson