Tony Cheng recently opened a restaurant in Hobart serving Asian Creole food, as well as exporting its

Question:

Tony Cheng recently opened a restaurant in Hobart serving Asian Creole food, as well as exporting its own brand of spice mixture. The business is registered for GST, and accounts for GST on an accrual basis using a monthly tax period.

Summarised below are the events that need to be considered in preparing the Business Activity Statement for June 2016:

1. On 2 June, a grinding machine was acquired for $1100 (including GST). It is estimated that 85 per cent of the grinder's usage will be for the restaurant business and the rest to make spice mixture for export.

2. Fresh food was purchased for $65 000 (GST free).

3. Invoices for other purchases totalled $9900. At the end of the month, inventory to the value of $230 was still in store and Cheng still owed $2475.

4. Cash sales in the restaurant were $264 000, including GST.

5. Credit sales of spice mixture totalled $13 500, of which only $12 000 was collected during the month.

6. The restaurant owner estimates that 5 percent of all acquisitions are for private use.

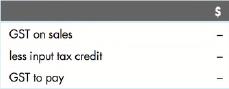

Determine the following items for Tony Cheng's Business Activity Statement for the month of June:

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson