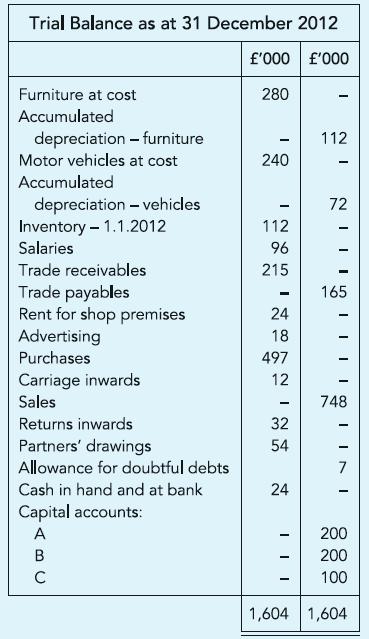

A, B and C carried on a business in partnership. They extracted their year-end Trial Balance as

Question:

A, B and C carried on a business in partnership. They extracted their year-end Trial Balance as shown. You are informed as follows:

(i) Goods costing £20,000 removed by partner A for personal use have not been accounted for.

(ii) Inventory costing £152,000 remains unsold.

(iii) Shop premises belong to partner B and rent is agreed at £3,000 per month.

(iv) Furniture and vehicles are to be depreciated at 10% and 20% per annum respectively, using the straight-line method.

(v) £8,000 salaries remain unpaid.

(vi) £15,000 of trade receivables should be written off and allowance for doubtful debts adjusted to cover 5% of remaining receivables.

(vii) Partners A, B and C drew £2,000, £1,500 and £1,000 respectively each month.

Required:

(a) Partner’s Capital accounts in columnar form.

(b) Partner’s Current accounts in columnar form.

(c) The Statement of income of the partnership for the year ended 31 December 2012.

(d) The Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict