A business owned by Philip Saunders sold some of its furniture for 18,000 on 31 December 2010,

Question:

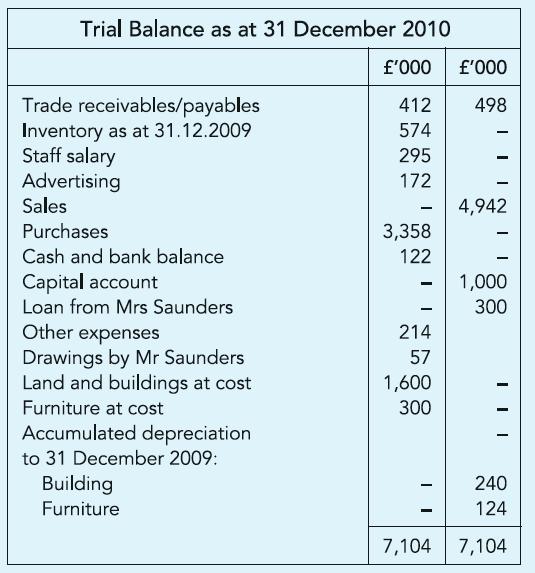

A business owned by Philip Saunders sold some of its furniture for £18,000 on 31 December 2010, but had not accounted for the disposal when the year-end Trial Balance was extracted as shown.

You are informed as follows:

(a) Cost of inventory at year-end was £498,000.

(b) Furniture sold on the last day of the period had been acquired for £60,000 on 1 January 2008.

(c) Inventory costing £4,000 removed by Philip for personal use has not been accounted for.

(d) One-fourth of the cost is attributed to land which is not depreciated. Buildings and furniture are depreciated, using the straight-line method, at 2% and 10% per annum respectively.

(e) Interest, at 5% per annum, should be paid on the loan from Mrs Saunders obtained in 2008.

Required:

The Statement of income for the year ended 31 December 2010 and the Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict