A wholesale merchant effects his sales at cost plus 20%. His accounting period ended on 31 March

Question:

A wholesale merchant effects his sales at cost plus 20%. His accounting period ended on 31 March 2011 but he was able to ascertain the cost of his unsold goods as £482,800 when he conducted a physical inventory on 5 April. Assuming that the remainder of information is as stated in each of the following alternative circumstances, ascertain the cost of ‘closing’ inventory as at 31 March:

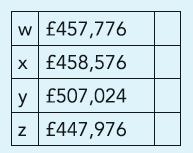

(a) Purchases and sales, during the five days since 31 March, were £78,400 and £58,800 respectively. The cost of packing material at £4,500 and £800, being the cost of stationery remaining unused, has been included in the inventory along with £124, the cost of spark plugs acquired for vehicle maintenance

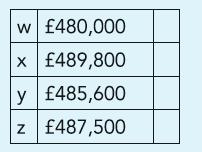

(b) During the five days since 31 March purchases were £84,200 though goods costing £5,400 did not arrive till 7 April. Sales were £95,700, but goods invoiced for £4,500 were delivered to customers after 6 April

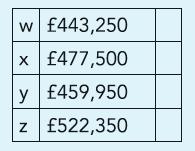

(c) Purchases and sales during the five days since 31 March were £79,400 and £105,300 respectively. An inventory sheet total has been carried forward from one page to another as £342,800 instead of £324,800. 48 units of an item were stated as £300 each whereas the real cost of these items was £300 per dozen

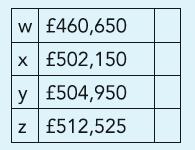

(d) Purchases and sales during the five days since 31 March were £82,400 and £97,200 respectively. As at 31 March goods invoiced to customers at £37,350 were with customers, on approval. A third of these goods were returned by the customers on 4 April

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict