Bell plc, manufacturers of laptop computers, acquired a machine for 360,000 on 1 January 2008 with an

Question:

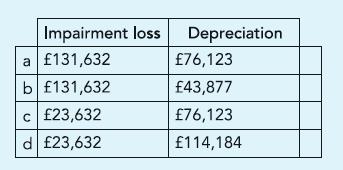

Bell plc, manufacturers of laptop computers, acquired a machine for £360,000 on 1 January 2008 with an expectation that it could be used for ten years. Depreciation was on the straight-line method. The model for the production of which this machine is used is not Skype capable. In the circumstances, as at 1 January 2011 the sales in 2011 are expected to be £120,000 and in 2012 and 2013 £80,000 and £40,000 respectively. Sale of the model thereafter and the proceeds from disposal of the machine are not expected to be significant. Cost of capital for Bell plc is 8% per annum. What is the impairment loss as at 1 January 2011 and the depreciation written off in the year ended 31 December 2011?

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict