During the year ended 30 June 2012 Middle plc sold for 78,000 a machine acquired for 200,000

Question:

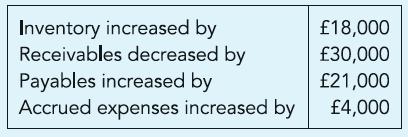

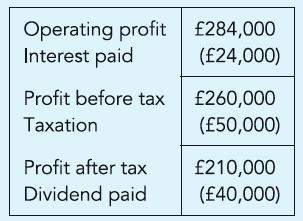

During the year ended 30 June 2012 Middle plc sold for £78,000 a machine acquired for £200,000 and written down to £52,000. You are provided with an extract of the company’s Statement of income as shown. The non-current assets have been depreciated in the year by £28,000 and working capital changes in the year were as stated. The tax liability was reported as £39,000 on 30 June 2011 and as £52,000 on 30 June 2012.

Required:

Identify the cash flow from operating activities in the year ended 30.6.2012.

Clue: operating profit stated in the extract includes the gain on machine disposal.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted: