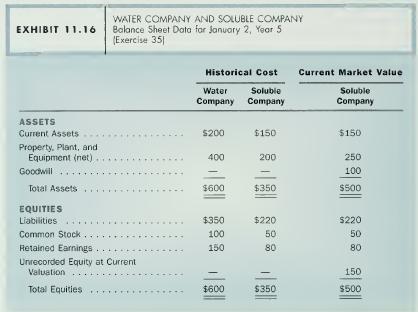

Question: Financial statement effects of purchase and pooling-of-interests methods. (Requires coverage of Appendix I 1.2.) Exhibit 1 1.16 presents condensed balance sheet data for Water Company

Financial statement effects of purchase and pooling-of-interests methods. (Requires coverage of Appendix I 1.2.) Exhibit 1 1.16 presents condensed balance sheet data for Water Company and Soluble Company on January 2, Year 5. On this date, Water Company exchanges common stock with a market value of $280 for all ol the outstanding common slock of Soluble Company.

a. Prepare a consolidated balance sheet for Water Company and Soluble Company as of January 2. Year 5. using (1) the purchase method and (2) the pooling-of- interests method.

b. Projected net income for Year 5 before consideration of the corporate acquisition was $60 for Water Company and $20 for Soluble Company. These firms intend to amortize any excess acquisition cost allocated to property, plant, and equipment over five years and any excess allocated to goodwill over 20 years. Compute the amount of consolidated net income projected for Year 5 assuming that these firms account for the corporate acquisition using (1) the purchase method and (2) the pooling-of-interests method.

EXHIBIT 11.16 ASSETS WATER COMPANY AND SOLUBLE COMPANY Balance Sheet Data for January 2, Year 5 (Exercise 35 Historical Cost Current Market Value Water Soluble Soluble Company Company Company Current Assets Property, Plant, and $200 $150 $150 Equipment (net) 400 200 250 Goodwill. 100 Total Assets $600 $350 $500 EQUITIES Liabilities $350 $220 $220 Common Stock... 100 50 50 Retained Earnings. 150 80 80 Unrecorded Equity at Current Valuation.. 150 Total Equities $600 $350 $500

Step by Step Solution

3.24 Rating (153 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts