Lydall plc seeks your advice on how it should treat the following items, when preparing its financial

Question:

Lydall plc seeks your advice on how it should treat the following items, when preparing its financial statements for the year ended 31 December 2011:

(a) £50,000 was paid as an out-of-court settlement to a customer on 7 May 2011, as compensation for injuries suffered in company premises on 24.1.2011.

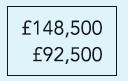

(b) On 17 January 2012, before 2011 financial statements were approved, following amounts misappropriated by staff are identified:

Misappropriation until 31 December 2010

Misappropriation in the year to 31 December 2011

The amounts cannot be recovered either from members of staff, who have all been dismissed, or from insurance.

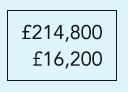

(c) Buildings, not depreciated until now, are to be depreciated. The amount of the depreciation has been calculated as follows:

Backlog until 31 December 2010

Current year depreciation in the year to 31 December 2011

(d) Corporation tax, in respect of the year ended 31 December 2010, provided for at £79,800, was settled on 1 October 2011 at £76,500.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict