Question: Preparing pro forma financial statements (requires Appendix 5.1). Problem 27 presents financial statements for Wal-Mart Stores, Inc.. for Year 6, Year 7. and Year 8,

Preparing pro forma financial statements (requires Appendix 5.1). Problem 27 presents financial statements for Wal-Mart Stores, Inc.. for Year 6, Year 7. and Year 8, as well as financial statement ratios.

a. Prepare a set of pro forma financial statements for Wal-Mart Stores, Inc., for Year 9 through Year 12 using the following assumptions:

Income Statement 1. Sales will grow 12 percent.

2. Cost of goods sold will equal 78.5 percent of sales.

3. Marketing and administrative expenses will equal 16.5 percent of sales.

4. Interest expense will equal 7 percent of average interest-bearing debt.

5. Income tax expense will equal 37 percent of income before income taxes.

Balance Sheet 6. Cash will equal the amount necessary to equate total assets with total liabilities plus shareholders" equity.

7. Accounts receivable will increa.se at the growth rate in sales.

8. Inventory will increa.se at the growth rate in sales.

9. Prepayments will increase at the growth rate in sales.

10. Plant assets (net) will grow at 14.0 percent per year 11. Other assets will increase at the growth rate in sales.

12. Accounts payable will turn o\er I 1.0 times per year

13. Current maturities of long-term debt on January 31 of each year are as fol- lows: Year 8: $1,141: Year 9: $1,039; Year 10: $815: Year 11: $2.018: Year 12: $52. 14. Other current liabilities will grow at the growth rate in sales. 15. Long-term debt will decrease by the amount of long-term debt reclassified as a current liability, and the remaining amount will grow at the growth rate in property, plant, and equipment. 16. Other noncurrent liabilities will increase at the growth rate in sales. 17. Common stock and additional paid-in capital will not change. 18. Dividends will increase at a 20 percent growth rate.

Statement of Cash Flows 19. Depreciation expense will increase at the growth rate in property, plant, and equipment. 20. The change in Other Noncurrent Assets is an investing activity. 21. The change in Other Noncurrent Liabilities is an operating activity.

b. Describe actions that Wal-Mart Stores. Inc.. might take to deal with the shortage of cash projected in part a.

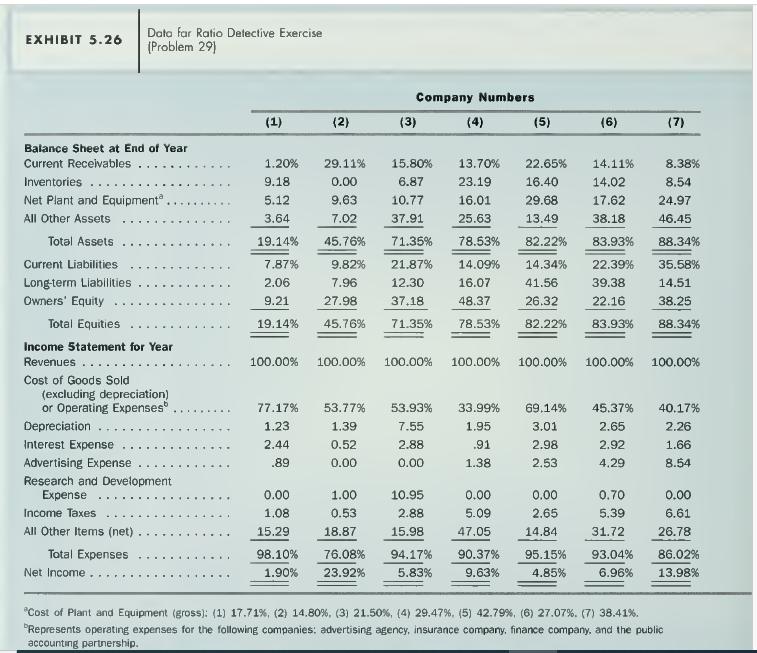

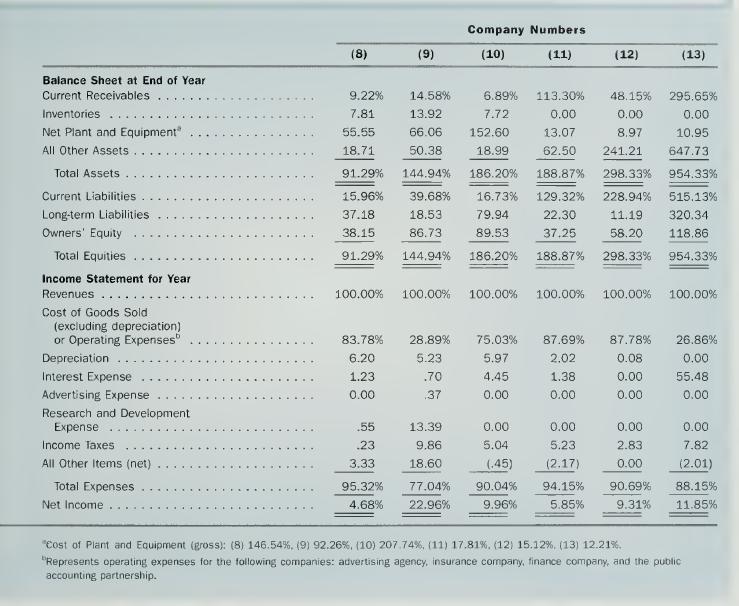

EXHIBIT 5.26 Data far Ratio Detective Exercise (Problem 29) Company Numbers (1) (2) (3) (4) (5) (6) (7) Balance Sheet at End of Year Current Receivables 1.20% 29.11% 15.80% 13.70% 22.65% 14.11% 8.38% Inventories .... 9.18 0.00 6.87 23.19 16.40 14.02 8.54 Net Plant and Equipment 5.12 9.63 10.77 16.01 29.68 17.62 24.97 All Other Assets 3.64 7.02 37.91 25.63 13.49 38.18 46.45 Total Assets Current Liabilities Long-term Liabilities 19.14% 45.76% 71.35% 78.53% 82.22% 83.93% 88.34% 7.87% 9.82% 21.87% 14.09% 14.34% 22.39% 35.58% 2.06 7.96 12.30 16.07 41.56 39.38 14.51 Owners' Equity 9.21 27.98 37.18 48.37 26.32 22.16 38.25 Total Equities 19.14% 45.76% 71.35% 78.53% 82.22% 83.93% 88.34% Income Statement for Year Revenues 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% Cost of Goods Sold (excluding depreciation) or Operating Expenses 77.17% 53.77% 53.93% 33.99% 69.14% 45.37% 40.17% Depreciation 1.23 1.39 7.55 1.95 3.01 2.65 2.26 Interest Expense 2.44 0.52 2.88 .91 2.98 2.92 1.66 Advertising Expense .89 0.00 0.00 1.38 2.53 4.29 8.54 Research and Development Expense 0.00 1.00 10.95 0.00 0.00 0.70 0.00 Income Taxes 1.08 0.53 2.88 5.09 2.65 5.39 6.61 All Other Items (net). 15.29 18.87 15.98 47.05 14.84 31.72 26.78 Total Expenses Net Income.. 98.10% 1.90% 76.08% 94.17% 23.92% 5.83% 90.37% 95.15% 93.04% 86.02% 9.63% 4.85% 6.96% 13.98% "Cost of Plant and Equipment (gross): (1) 17.71 %, (2) 14.80 %, (3) 21.50 %, (4) 29.47 %. (5) 42.79 %, (6) 27.07%. (7) 38.41%. "Represents operating expenses for the following companies: advertising agency, insurance company, finance company, and the public accounting partnership.

Step by Step Solution

3.29 Rating (164 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts