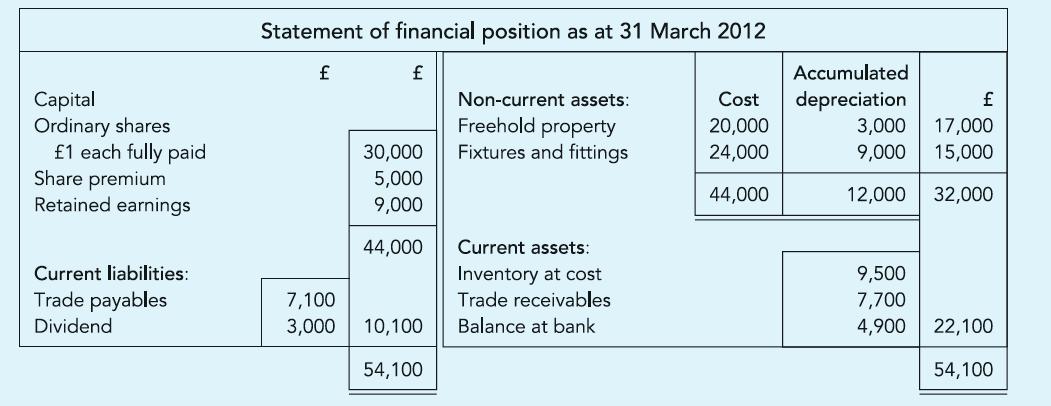

Steadfast Stores Ltd has drafted its Statement of financial position as set out below. Since preparing the

Question:

Steadfast Stores Ltd has drafted its Statement of financial position as set out below.

Since preparing the draft the following information has become available:

(i) Goods received from B. Brown in February 2012 on a sale or return basis and all unsold as at 31 March 2012 have been regarded as outright purchases at the pro forma invoice cost of £4,000 by the accountant of Steadfast Stores Ltd. Steadfast Stores intends to return these goods.

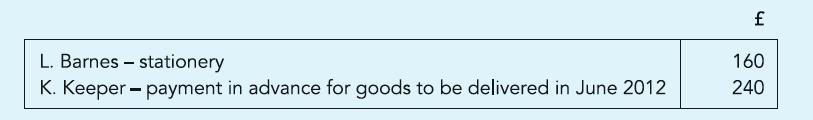

(ii) The bank balance reported is without making any accounting entry for two cheques, stated below:

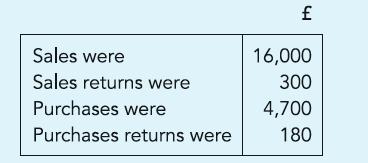

(iii) The inventory-taking took place on 6 April 2012 instead of on the accounting year-end. During the period from 31 March 2012 to 6 April 2012 transactions stated on the right took place. Note: Steadfast Stores Ltd obtains a uniform rate of gross profit of 25% on selling price.

Note: Steadfast Stores Ltd obtains a uniform rate of gross profit of 25% on selling price.

(iv) The company acquired a quantity of stationery in March 2012 at a special price of £1,000. The acquisition of this stationery, none of which has been used yet, has been charged to fixtures and fittings. Assume that the depreciation charge for the year ended 31 March 2012 has not been affected by this item.

(v) One of the stock sheets prepared on 6 April 2012 was undercast by £300.

(vi) Adjustments have not been made in the accounts for discounts received from suppliers of £340 during the year ended 31 March 2012.

Required: The corrected Statement of financial position as at 31 March 2012 of Steadfast.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict