Tax in respect of 2010, accounted for at 148,500, was settled on 1 October 2011 paying 154,400.

Question:

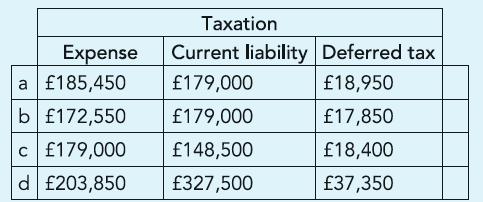

Tax in respect of 2010, accounted for at £148,500, was settled on 1 October 2011 paying £154,400. Tax on the profits in 2011 is estimated at £179,000. As at 31 December 2011 the tax base is £75,800 lower than the written-down value of the corresponding assets. A balance of £18,400 is available in the Deferred tax account. Tax rate applicable is 25%. Identify the tax expense to be included in the Statement of income for 2011 and the tax liability to be reported in the Statement of financial position as at 31 December 2011.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted: