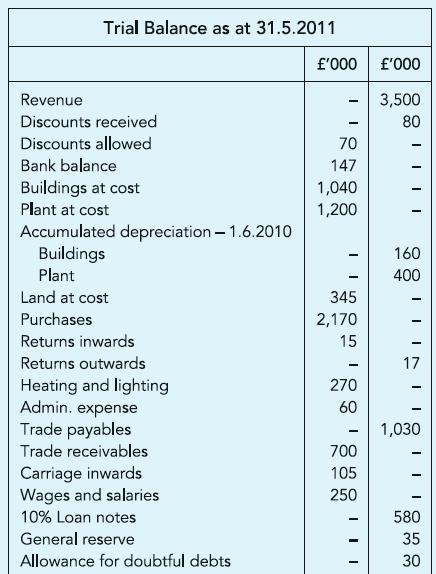

The Trial Balance of Adnett Ltd is shown. Additional information: (a) Cost of closing inventory is 560,000.

Question:

The Trial Balance of Adnett Ltd is shown.

Additional information:

(a) Cost of closing inventory is £560,000.

(b) There are wages and salaries to be paid of £42,000.

(c) Loan notes interest has not been paid in the year.

(d) Allowance for doubtful debts is to be increased to £40,000.

(e) Plant is to be depreciated at 25% p.a. using the reducing balance method.

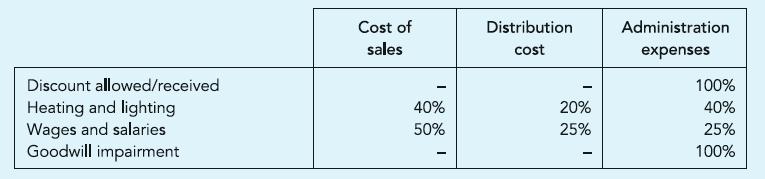

(f) Buildings are depreciated at 5% p.a. on cost, allocated as 25% to cost of sales, 50% to distribution cost and 25% to administrative expenses.

(g) On 1 August 2010 Adnett acquired and absorbed another business as a going concern. Adnett paid £85,000 for goodwill and £35,000 for inventory. Acquisition was paid for by the issue of 100,000 ordinary shares of £1 each. The transaction has not yet been recorded in the books of Adnett. As at 31 May 2011 the fair value of goodwill was £68,000.

(h) During May 2011 a bonus issue of one for five was made to ordinary shareholders. This has not been entered in the books. The Share premium account is to be used for this purpose.

(i) Directors have declared a dividend of 3p per share on ordinary shares and have decided to transfer £35,000 from the profits of the company to general reserves.

(j) Tax on profits for the year ended 31 May 2011 is estimated at £70,000.

(k) Expenses are to be apportioned as:

Required:

(a) Prepare, for external use, the Statement of income for the year ended 31 May 2011 and the Statement of financial position as at that date.

(b) Briefly explain the accounting treatment for purchased goodwill.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict