The year-end Trial Balance of Cavalier plc, as at 30 June 2012, reports Development costs at an

Question:

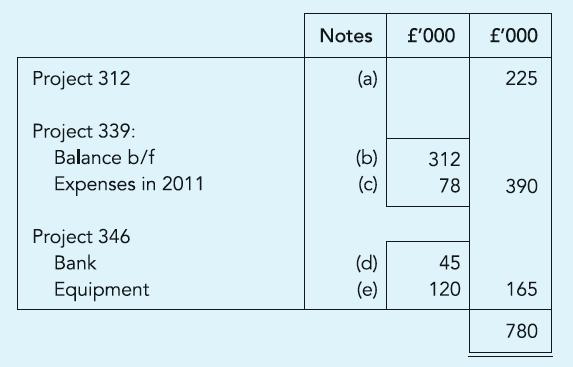

The year-end Trial Balance of Cavalier plc, as at 30 June 2012, reports Development costs at an amount of £780,000. The break-down of this amount is as shown. You are informed as follows:

(a) The commercial exploitation of Project 312 commenced on 1 July 2010. The cost of this project is being amortised over ten years using the straight-line method.

(b) The Project 339 fully met the capitalisation criteria on 1 July 2011 and commercial exploitation of the project is expected to commence by 2014.

(c) The costs relating to Project 339, which had been written off before the project met the capitalisation criteria, have now been capitalised.

(d) Project 346 is a new one, on which £45,000 has been incurred exploring the technical feasibility as well as the market potential. Cavalier has all the resources as well as the commitment to complete this project.

(e) £120,000 is the cost of equipment acquired for Project 346 on 1 January 2012. The equipment is expected to have a useful life of four years, no scrap value and is usually depreciated using the straight-line method.

Required:

Advise Cavalier plc on how it should treat the above information when preparing the financial statements for the year ended 30 June 2012.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict