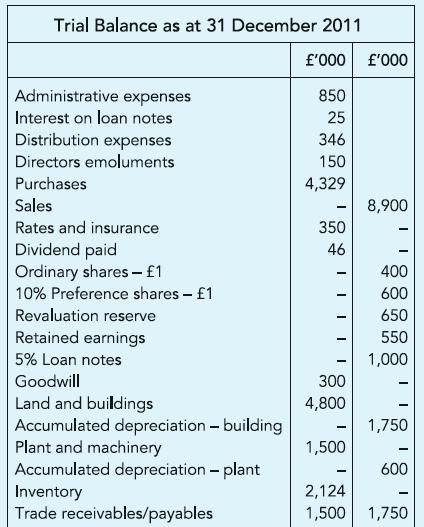

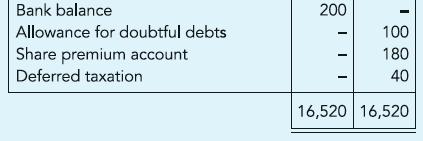

The year-end Trial Balance of Cheapstake plc, prepared by your predecessor, is shown. You are informed: (i)

Question:

The year-end Trial Balance of Cheapstake plc, prepared by your predecessor, is shown.

You are informed:

(i) The credit control department advises that:

~ A debt of £25,000 should be written off;

~ Allowance should be increased by 50%;

~ A debt of £15,000, previously written off, should be accrued.

(ii) Goodwill acquired when the business started is impaired by £120,000.

(iii) Inventory on 31.12.2011 is £1,950,000.

(iv) The buildings are depreciated at 10% per annum and plant and machinery at 20% per annum on cost. The land and buildings are subject to revaluation every three years. The review on 31.12.2011 reduces the value of land and buildings by £300,000. The balance in the Revaluation reserve is gains on revaluation of land and buildings. Assume that a third of the value relates to land.

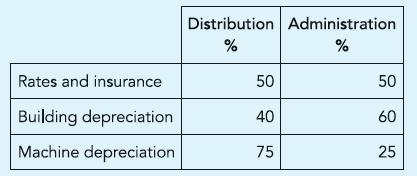

(v) Allocate as follows

(vi) Tax, at 20%, is estimated on current year’s profit, at £105,000. The tax base as at 31 December 2011 is £140,000 lower than the written-down value of the corresponding assets.

(vii) There is an outstanding claim of £200,000 from a customer relating to supply of faulty goods. This is not covered by insurance. The outcome is uncertain and the amount of the damage is not quantifiable.

(viii) The amount reported as dividend paid includes one-half of the current year’s preference dividend.

Required:

(a) Prepare for publication the Statement of income for the year ended 31 December 2011, together with the Statement of changes in equity and the Statement of financial position as at that date.

(b) Write a note explaining your treatment of information stated in (vii) above.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict