Question: Working backward from purchase data. (Requires Appendix 11.2; adapted from a problem by S. A. Zeff.) On May 1, Year 1, Homer acquired the assets

Working backward from purchase data. (Requires Appendix 11.2; adapted from a problem by S. A. Zeff.) On May 1, Year 1, Homer acquired the assets and agreed to pay the liabilities of Tonga in exchange for 10,000 of Homer's common shares. Homer accounted for the acquisition of the net assets of Tonga using the purchase method. On the date of acquisition Tonga's book value of depreciable assets exceeded Homer's estimate of their market value, but Homer judged all other items on Tonga's books to reflect market value on that date. On the date of the acquisition, Tonga's shareholders' equity was \(\$ 980,000\). Tonga reported no goodwill on its balance sheet.

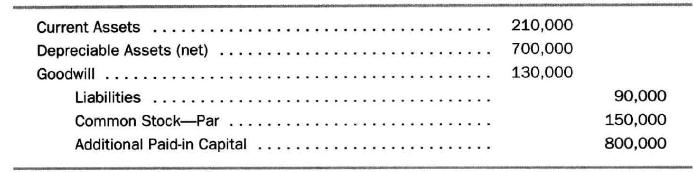

Homer made the following journal entry to record the acquisition:

a. What was the book value on Tonga's books of its total assets just before the acquisition?

b. What was the book value of depreciable assets of Tonga just before the acquisition?

Current Assets Depreciable Assets (net) Goodwill Liabilities Common Stock-Par. Additional Paid-in Capital 210,000 700,000 130,000 90,000 150,000 800,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts