Broadbury Ltd is a family-owned clothes manufacturer. For a number of years the chairman and managing director

Question:

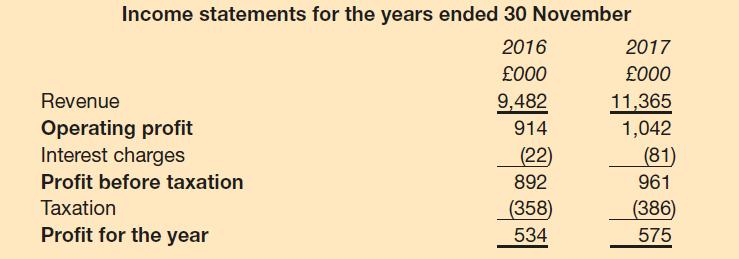

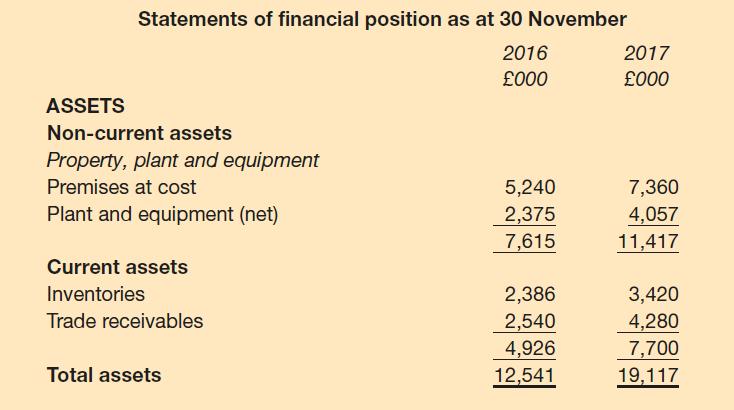

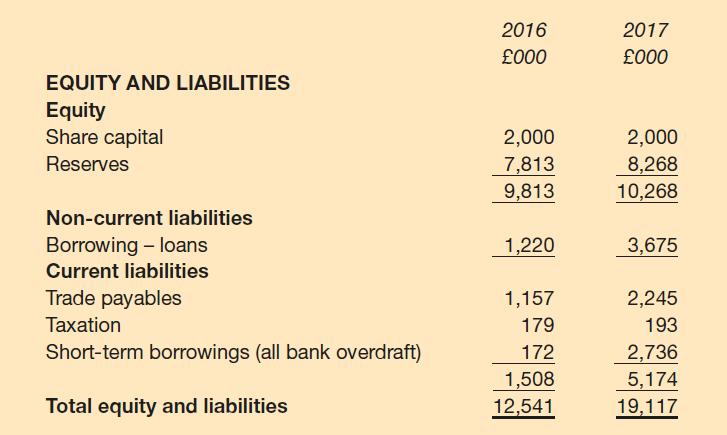

Broadbury Ltd is a family-owned clothes manufacturer. For a number of years the chairman and managing director was David Broadbury. During his period of office, sales revenue had grown steadily at a rate of 2 to 3 per cent each year. David Broadbury retired on 30 November 2016 and was succeeded by his son Simon. Soon after taking office, Simon decided to expand the business. Within weeks he had successfully negotiated a five-year contract with a large clothes retailer to make a range of sports and leisurewear items. The contract will result in an additional £2 million in sales revenue during each year of the contract. To fulfil the contract, Broadbury Ltd acquired new equipment and premises.

Financial information concerning the business is given below:

Dividends of £120,000 were paid on ordinary shares in respect of each of the two years.

Required:

(a) Calculate, for each year (using year-end figures for statement of financial position items), the following ratios:

1. Operating profit margin

2. Return on capital employed

3. Current ratio

4. Gearing ratio

5. Trade receivables settlement period

6. Sales revenue to capital employed.

(b) Using the above ratios, and any other ratios or information you consider relevant, comment on the results of the expansion programme.

Step by Step Answer:

Financial Accounting For Decision Makers

ISBN: 9781292251257

9th Edition

Authors: Peter Atrill, Eddie McLaney