Ondamin plc produced a draft income statement that revealed a profit before tax of 65.5million. Subsequent checking

Question:

Ondamin plc produced a draft income statement that revealed a profit before tax of £65.5million. Subsequent checking of the underlying records revealed the following:

1. A licence costing £10 million was acquired at the beginning of the year, which has a remaining legal life of 10 years. The licence has been amortised, on a straight-line basis for the year. The commercial director believes, however, that the licence could be sold in the market for £15 million. The board of directors has, therefore, decided to switch to using the fair value of the asset from the current year onwards.

2. A masthead has been developed during the year at an estimated cost of £6.0 million. The business has decided to write-off this amount evenly over the next 10 years and so an appropriate charge was included in the current year’s income statement. However, the commercial director believes that the masthead has an indefinite life.

3. Research expenditure of £2.0 million was incurred during the year. The business wishes to write this off over the next five years, using the straight-line method, and an appropriate charge was included in the current year’s income statement.

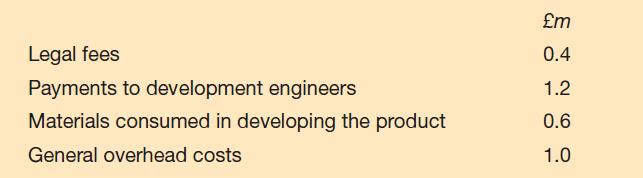

4. Development costs incurred during the year relating to a new product were as follows:

These amounts are to be written off evenly over a five-year period. An appropriate charge was, therefore, included in the current year’s income statement.

Required:

Recalculate the profit before tax for the current year. Explain any adjustments and any assumptions that you make in doing so.

Step by Step Answer:

Financial Accounting For Decision Makers

ISBN: 9781292251257

9th Edition

Authors: Peter Atrill, Eddie McLaney