Asian Paints is Indias largest and Asias third largest paint company. It manufactures a wide range of

Question:

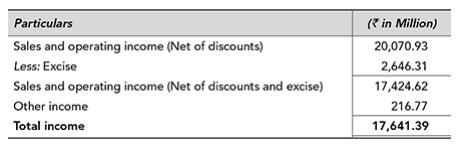

Asian Paints is India’s largest and Asia’s third largest paint company. It manufactures a wide range of paints for decorative and industrial use. For the year 2003–04, the company reported a total income of ₹17,641.39 million and a net profit of ₹1,477.87 million. The breakup of the income as reported in the profit and loss account is given as follows:

The sales and operating income includes a sum of ₹539.01 million as interdivision transfers. The accounting policy of the company states that ‘Interdivision transfers of finished goods for captive consumption are valued at market price. The value of such interdivision transfers is included in the materials consumption of the consuming divisions. The yearend stock of such transferred goods is valued at cost.’

The next year (2004–05) the company decided to change its accounting policy. The revised accounting policy of the company stated that ‘sale of products is recognized when the risks and rewards of ownership are passed on to the customers, which is on dispatch of goods. Sales are stated exclusive of sales tax. Processing income is recognized upon rendition of the services.’

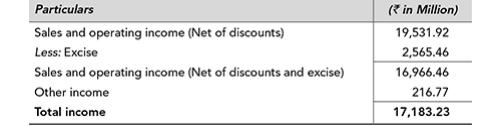

The company further states that ‘Hitherto, the company has been recognizing interdivision transfers of Phthalic Anhydride and Pentaerythritol to paint plants for captive consumption as revenue and the same was disclosed separately in “Sales & Operating Income”. The value of such interdivision transfers was included in material consumption of the consuming divisions. With effect from the financial year ended 31st March 2005, the company has discontinued the method of recognizing interdivision transfers as sales as well as material consumption. The previous year’s figures have been restated accordingly. The above change in the method of revenue recognition has resulted in a reduction in net sales and operating income by ₹600.28 million (previous year ₹458.16 million) with a corresponding reduction in material consumption and has no impact on the profits of the company’.

As a consequence of the change, the company recasted the figures for the year 2003–04 as well. The recasted income details are given as follows:

Though the company reported a lower total income there was no impact on the profit after tax.

Questions for Discussion

1. Sales and operating Income are shown net of discounts and excise duty. Why?

2. Is inclusion of interdivision transfers in the income consistent with the requirements of AS 18?

3. What is the impact of such inclusion on the total income and net profit of the company?

Step by Step Answer: