Question: The Indian business and investor community received a shock on 7th January 2009 when Mr. Ramalinga Raju, CEO of Satyam Computer Limited (Satyam), by a

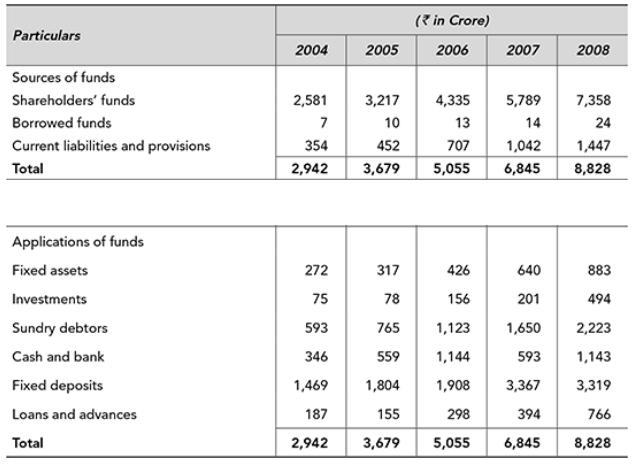

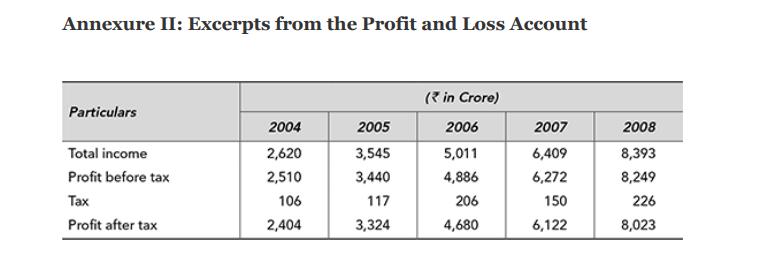

The Indian business and investor community received a shock on 7th January 2009 when Mr. Ramalinga Raju, CEO of Satyam Computer Limited (Satyam), by a letter to the board of directors admitted falsification of account to the tune of over ₹ 70,000 million. Satyam at that time was the fourth largest IT Company in India with over $2 billion in turnover and employing over 50,000 employees. Just three months back, it declared its half yearly results for the six months ended 30th September 2008 with total income of ₹ 53,405 million and a net profit of ₹ 11,733 million. The company has been showing impressive results year after year. The excerpts from the balance sheet and profit and loss account of the company for five years up to 2007–08 are given in Annexure-I and Annexure-II, respectively.

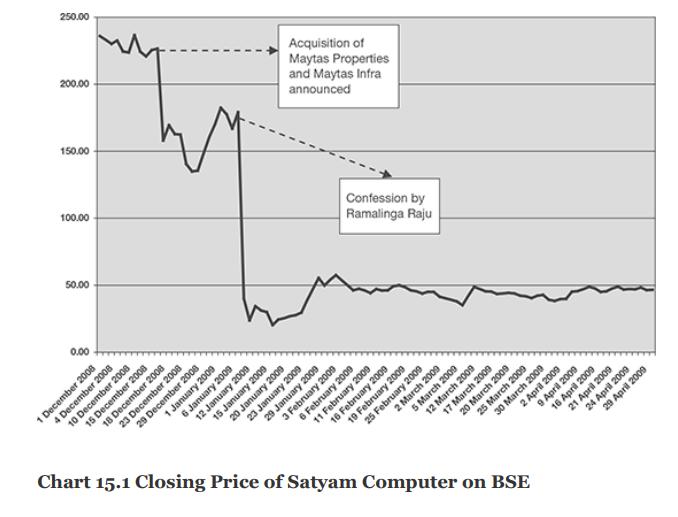

The immediate trigger for this confession was provided by the aborted attempt by Satyam to acquire 51% stake in Maytas Infra and 100% stake in Maytas Properties— both companies promoted by Mr. Raju’s sons. On 16th December 2008, the company informed the stock exchanges that board of directors of the company has approved the proposals to acquire Maytas Infra Limited with controlling stake and Maytas Properties Limited as a wholly owned subsidiary. The company said that the acquisition of Maytas’ two companies will cost it $ 1.6 billion. The company justified the acquisition by saying that the move is driven by a need to adopt diversification strategy. It will derisk the core business of the company as a new vertical—mitigated risk in developed markets. The two companies offer significant upside in the future. The move to acquire these companies invoked strong reactions from the stock market, institutional investors and the brokerage houses. It was taken as a major corporate governance issue and loss of credibility. The very next day, the company announced that it is not going ahead with its proposed acquisition in light of the feedback received from the investor community. Commenting on this decision, Mr. Raju said, ‘We have been surprised by the market reaction to this decision even though we were quite positive about the merits of the acquisition. However, in deference to the views expressed by many investors, we have decided to call off these acquisitions’.

The next two days witnessed resignations of nonexecutives directors including Krishna Palepu, Mangalam Srinivasan Vinod Dham and M. Rammohan Rao. Mr. Rao was the Dean of the prestigious Indian School of Business (ISB) Hyderabad and had chaired the meetings of the board of directors on 16th December 2008 where the controversial acquisitions were approved. He also stepped down as a Dean of ISB a few months advance of his term to save any kind of embarrassment to ISB. However, another independent director Mr. T. R. Prabhu stated that ‘I am of the view that resigning from the board now is like deserting a troubled ship. We should remember Satyam is a major player in global IT space, employing well over 50,000 of the best and the brightest of professionals, with vendor commitments to several global corporates and entities’.

Finally on 7th January 2009, Mr. Raju tendered his resignation by a letter addressed to the board of directors and admitting the massive fraud perpetuated over a period of time. The letter of resignation of Mr. Raju is given in Annexure-III.

Modus Operandi

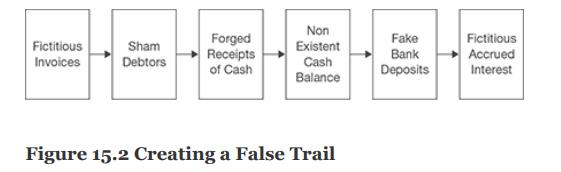

It appears that Satyam inflated its revenue by booking fictitious invoices (refer Box 15.8) as a result false receivables were also recognized. Fictitious entries were passed to record the receipts from these nonexistent debtors. These ‘cash balances’ were converted into bank deposits and interest was also accrued on these fictitious bank deposits. To create the necessary supporting documents fake invoices were created, banks’ statements were falsified and fake bank deposit receipts were created. The chain of sequence is depicted in Figure 15.2.

These fictitious debtors, bank balances and bank deposit should have been detected by the auditors as a part of standards audit procedures involving verification of bank deposits and receivables. That did not happen due to connivance with the auditors. Cash and cash equivalents (including bank deposits) constituted over 50% of the total assets of the company. The management attempted to bridge the hole so created by announcing acquisition of controlling stake in two related entities.

Auditors

The accounts of Satyam were audited by Price Waterhouse Coopers (PwC) from June 2000 until September 2008. Mr. Subramani Gopalakrishnan, partner at the PwC, has signed all the audit reports except one which was signed by Mr. Talluri Srinivas, another partner at PwC, during this period. After the outbreak of the scandal, both the partners were arrested. The firm is also being investigated by a committee set up by the Institute of Chartered Accountants of India (ICAI) for their role in the Satyam scam.

On 13th January 2009, PwC wrote to the board of Satyam stating that ‘we planned and performed the required audit and examined the books and records of the company produced before us by the company management. We placed reliance on management’s control over financial reporting and the information and explanation provided by the management as also the verbal and written representations made during the course of audit’. In February 2009, PwC resigned as statutory auditors of Satyam with a commitment to cooperate with the ongoing investigations.

Government’s Response

To ensure that there is no negative impact on India as an IT and BPO destination, the government moved swiftly and reconstituted the board of directors of the company on 11th January 2009. The newly constituted board said that the first priority of the board will be to ensure business continuity and to make sure that India continues to be a safe, secure and reliable destination for IT. The board decided to induct a strategic investor to buy Satyam by inviting bids. Expression of interest was received from bidders including Larsen & Toubro, Tech Mahindra, iGate and B K Modi’s Spice Corp. On 13th April 2009, Tech Mahindra won the bid for Satyam.

The company was renamed as Mahindra Satyam in June 2009. The government also moved Serious Fraud Investigation Office (SFIO) to look into the entire gamut of irregularities and other related anomalies in books of accounts and other acts of commission and omission including the role of directors, promoters and auditors.

Stock Market Reaction

The stock market reacted swiftly and severally. On 16th December 2008, over 500,000 shares were traded on the BSE and the shares closed at ₹ 226.50. The very next day when the deal for acquiring Maytas Properties and Maytas Infra was announced, the stock fell by over 30% and closed at ₹ 158.05 with over 33 million shares traded on the BSE alone. Again on 7th January 2009, after Mr. Raju’s confession, the stock closed at ₹ 39.95 on the BSE with a loss of 78% over the previous close. Over 143 million shares were traded on the BSE on that day. In 15 trading days between 17th December 2008 and 7th January 2009, the stock lost over 82% in value. The stock movement between 1st December 2008 and 31st March 2009 on the BSE is shown in Chart 15.1.

Questions for Discussion

1. Mr. Raju in his letter stated that ‘It was like riding a tiger, not knowing how to get off without being eaten’. What does ‘riding a tiger’ mean in this context?

2. Identify the financial shenanigans deployed by the management of Satyam and discuss the same within the framework of ‘motivations’ and ‘opportunities’.

3. Critically evaluate the role of independent directors and auditors of Satyam.

4. In his resignation letter Mr. Raju stated that none of the directors, senior executives or family members had any knowledge of the situation. Do you think such a massive fraud is possible without collusion?

Fictitious Invoices Sham Debtors Forged Receipts of Cash Non Existent Cash Balance Figure 15.2 Creating a False Trail Fake Bank Deposits Fictitious Accrued Interest

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

The situation described is concerning the Satyam Computer Services scandal that surfaced in 2009 which is one of the most significant corporate frauds in India to date The companys chairman Ramalinga ... View full answer

Get step-by-step solutions from verified subject matter experts