At the beginning of 2016, John Cornell decided to quit his job as a construction company ey

Question:

At the beginning of 2016, John Cornell decided to quit his job as a construction company ey supervisor and formed his own residential housing construction company. When he resigned, he had a contract to build a custom home at a price of \($400,000\). The full price was payable in cash when the house was completed.

By year-end 2016, Cornell’s new company Luxury Homes, Inc. had spent \($50,000\) for labor, \($107,740\) for materials, and \($3,800\) in miscellaneous expenses in connection with the construction of the new home. Cornell estimated that the project was 70 percent complete at year-end. In addition, construction materials on hand at year-end 2016 had cost \($2,600\).

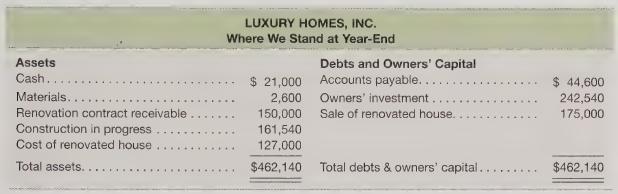

During the year, Luxury Homes, Inc., had also purchased a small house for \($95,000\), spent \($32,000\) fixing it up, and then sold it on November 1, 2016, for \($175,000\). The buyer paid \($25,000\) down and signed a note for the remainder of the balance due. The note called for interest at a rate of 12 percent per year, with a lumpsum payment for the outstanding balance payable at the end of 2018. John’s wife, Karen, kept the accounting records for Luxury Homes, Inc., and on December 31, she prepared the following statement:

After reviewing the statement, John and Karen got into a discussion concerning the level of revenue the company had earned during the year. John argued that all of the revenue from the sale of the renovated home, along with 70 percent of the expected revenue from the new construction contract, had been earned. Karen, on the other hand, maintained that the revenue on the renovation project should be recognized only to the extent of the cash actually collected and that no revenue should be recognized on the new home construction until it was completed and available for occupancy. John and Karen agreed that there were four possible alternative approaches to measuring the company’s revenue:

1. Report the entire amount of renovation revenue and a proportionate amount of the new construction contract revenue.

2. Report the entire amount of renovation revenue but none of the new construction contract revenue.

3. Report the renovation revenue in proportion to the amount of cash received and the new construction contract revenue in proportion to the amount of work completed.

4. Report the renovation revenue in proportion to the amount of cash received but none of the new construction contract revenue.

Required

Prepare the balance sheets and income statements that would result under each of the four approaches. Which set of statements do you believe best reflects the results of Luxury Homes, Inc. for 2016? Why?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris