Entrust, Inc., is a global provider of security software; it operates in one business segment involving the

Question:

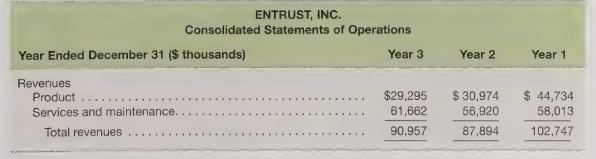

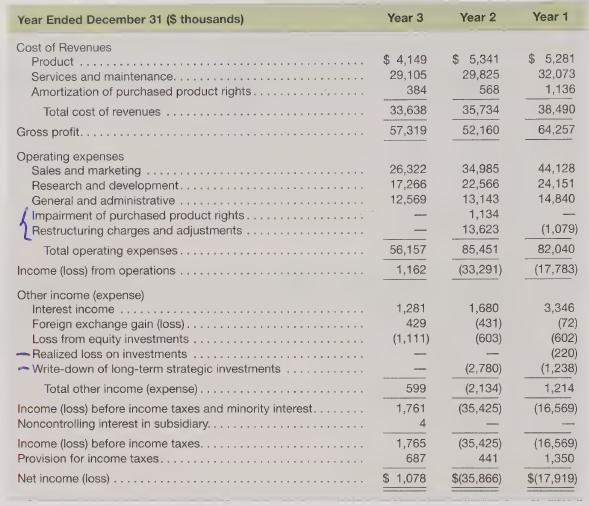

Entrust, Inc., is a global provider of security software; it operates in one business segment involving the design, production, and sale of software products for securing son digital identities and information. The consolidated statements of operations for a three-year period (all values in thousands) follows. On January 1, Year 1, the Entrust common shares traded at \($10.40\) per share; by yearend Year 3, the shares traded at \($3.80\) per share. The company’s cash flow from operations was \($(27,411), $(20,908),\) and \($9,606\), for Year 1, Year 2, and Year 3, respectively.

Calculate the sustainable earnings of Entrust, Inc., for each of the three years. Compare the company’s reported net income (loss) with its sustainable earnings. Does Entrust’s share price at year-end Year 3 reflect the firm’s apparent turn-around? Why or why not?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris