M. Beall Inc. uses the aging method to estimate the companys bad debt expense. Mike Beall, the

Question:

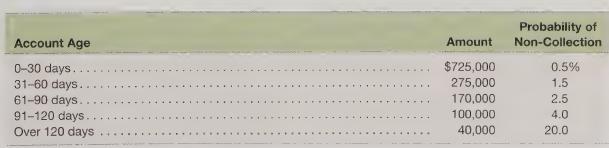

M. Beall Inc. uses the aging method to estimate the company’s bad debt expense. Mike Beall, the president of the company, collected information about the company’s outstanding accounts receivable and their probability of collection:

Calculate the allowance for uncollectible accounts for M. Beall, Inc., the total balance in accounts receivable, and the net realizable value of the company’s accounts receivable. Assume that M. Beall Inc. adopts a policy of writing off as worthless all unpaid accounts receivable over 120 days old. How will implementation of this policy impact the net realizable value of the company’s accounts receivable? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris

Question Posted: