Swift Trucking Company purchased a long-haul tractortrailer for ($400,000) at the beginning of the year. The expected

Question:

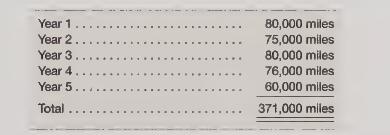

Swift Trucking Company purchased a long-haul tractortrailer for \($400,000\) at the beginning of the year. The expected useful life of the tractor-trailer rig was eight years or 500,000 miles. Salvage value was estimated to be \($40,000\). During the first five years of use, the rig logged the following usage in miles:

Calculate the depreciation expense to be taken on the tractor-trailer for each year using

(a) the units-ofproduction method and

(b) the straight-line method. Which method gives you higher total depreciation charges over the five-year period?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris

Question Posted: