Question: The following inventory data is taken from the financial records of Fernandez, Inc., a personal computer software manufacturer. Required 1. Complete the following table. 2.

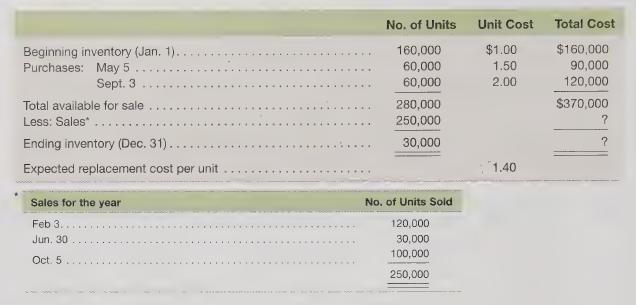

The following inventory data is taken from the financial records of Fernandez, Inc., a personal computer software manufacturer.

Required

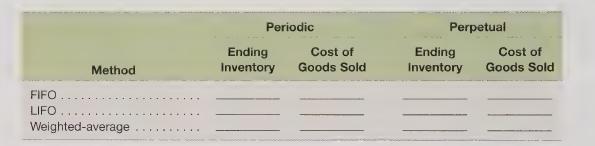

1. Complete the following table.

2. Which inventory method would you recommend that Fernandez, Inc., use for income tax purposes? Why?

3. Which method would you recommend that Fernandez, Inc., use for accounting purposes if the company operates in a highly inflationary environment? Why?

4. Which method would you recommend that Fernandez, Inc., use for accounting purposes if the company operates in a deflationary environment? Why?

Beginning inventory (Jan. 1).. Purchases: May 5 No. of Units Unit Cost Total Cost 160,000 $1.00 $160,000 60,000 1.50 90,000 60,000 2.00 120,000 280,000 $370,000 250,000 ? 30,000 1.40 Sept. 3 Total available for sale Less: Sales Ending inventory (Dec. 31). Expected replacement cost per unit Sales for the year Feb 3. Jun. 30 Oct. 5 No. of Units Sold 120,000 30,000 100,000 250,000

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts